URD 2024

-

Welcome

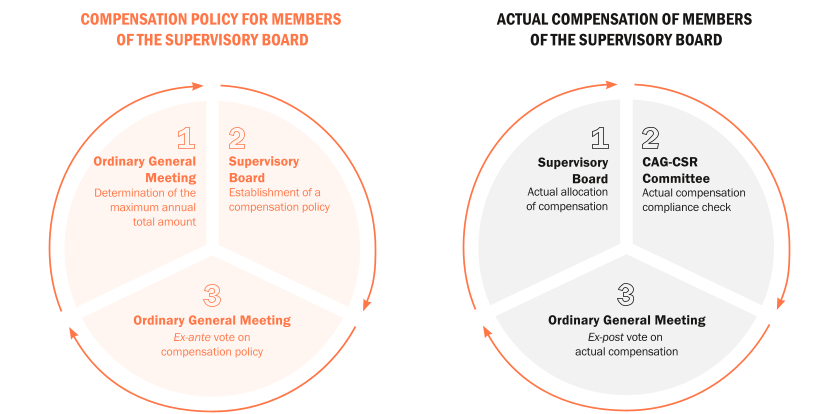

The French language version of this Document d’Enregistrement Universel (universal registration document) was filed on 27 March 2025 with the French Financial Markets Authority (Autorité des Marchés Financiers), as the competent authority under Regulation (EU) 2017/1129, without prior approval in accordance with Article 9 of said Regulation.

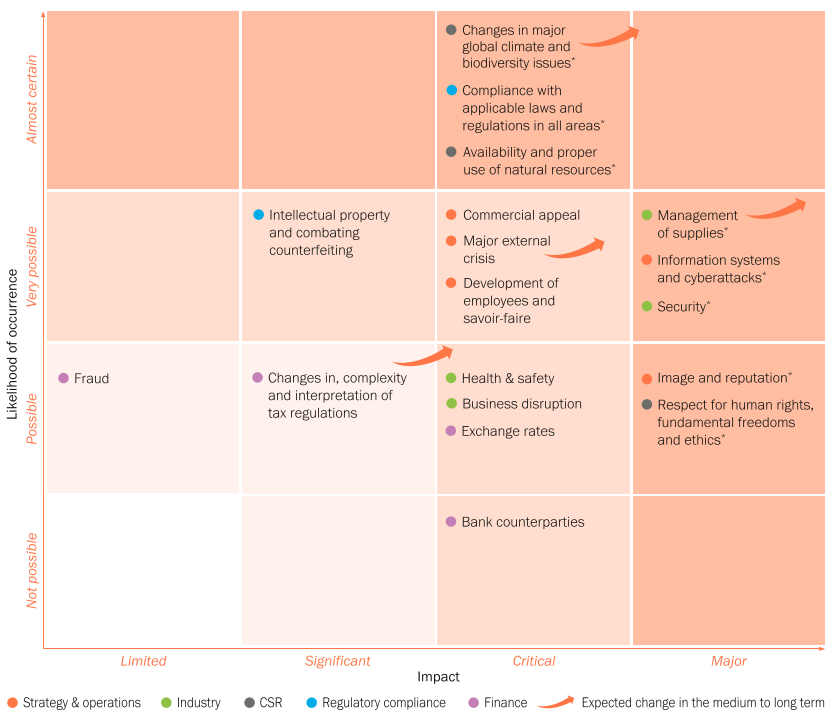

This Document d’Enregistrement Universel (Universal Registration Document) may be used for the purposes of a public offer of financial securities or the admission of financial securities to trading on a regulated market only if supplemented by a transaction note and, if applicable, a summary and all amendments to the Document d’Enregistrement Universel (Universal Registration Document). The group of documents then formed is approved by the French Financial Markets Authority in accordance with Regulation (EU) 2017/1129.

-

Message from the Executive Management

The year 2024 ended with results that bear witness to the robustness of our business model. This is something we can be proud of, and we would like to thank all our employees who have once again contributed to this success.

2024 was also a pivotal year. Today, the news is full of geopolitical complexity and one major climate crisis after another, highlighting the fragility of what we have previously taken for granted.

When times become more uncertain, refuges offer welcome relief. Our customers, both loyal and new, have appreciated the continuity of our approach oriented around creativity, uncompromising quality, and preserving and passing on know-how, all of which provides a guarantee of durability and authenticity.

Hermès’ recruitment initiatives – creating 2,300 jobs, around 1,300 of them in France – its commitment to training – with its 10 Écoles Hermès des savoir-faire – and to raising awareness – with the Manufacto programme run by the Fondation d'entreprise Hermès in 96 schools – all contribute to job creation, to safeguarding and promoting craftsmanship, and to regional development.

The house continued to follow its path in 2024, reaffirming the uniqueness of its integrated business model with the opening of the Maroquinerie de Riom leather workshop in September and the laying of foundation stones for future leather workshops in Loupes (Gironde) and L’Isle-d'Espagnac (Charente). The pace of store openings and the enhancement of the distribution network continued unabated, with new stores in Lille, Atlanta and Shenzhen marking the second half-year, following those in Princeton, Lee Gardens in Hong Kong, and Nantes earlier in the year. The group has also strengthened its vertical integration with the acquisition of the Dubai and Abu Dhabi concessions.

The creative abundance that thrives in all our métiers is testament to the talent and inspiration of our artistic directors. We would like to mention the successful launch of Barénia, the new women’s perfume by Christine Nagel, as well as the warmly-received eighth haute bijouterie collection designed by Pierre Hardy, and the success of the ready-to-wear collections by Nadège Vanhée and Véronique Nichanian. Charlotte Macaux Perelman and Alexis Fabry brought the home universe to life at Milan Design Week and throughout the year at presentations of the Tressages équestres dinner service.

2024 also brought success for our partner riders Jessica von Bredow-Werndl, Simon Delestre and Ben Maher in a thrilling competition at Versailles in the summer!

In a world of algorithms driven by technological acceleration, where uses are constantly evolving, emotion endures and humanity resists, imposing its desire for the beautiful, the good and the lighthearted as well as the sustainable. Perhaps this is what we should remember about 2024.

-

Highlights 2024

The Group’s consolidated revenue amounted to €15.2 billion in 2024, up by 15% at constant exchange rates and by 13% at current exchange rates compared to 2023. Recurring operating income reached €6.2 billion (40.5% of sales) and net profit (group share) reached €4.6 billion (30.3% of sales).

In the fourth quarter, sales reached €4.0 billion, increasing by 18% at constant exchange rates and current exchange rates. All the geographical areas confirmed solid growth, with a strong performance of the Americas in particular.

Axel Dumas, Executive Chairman of Hermès, said: “In 2024, in a more uncertain economic and geopolitical context, the solid performance of the results attests to the strength of the Hermès model and the agility of the house’s teams, whom I thank warmly. While preserving the group’s major balances and its responsibility as an employer, the house is staying the course, attached more than ever to its fundamental values of quality, creativity and savoir-faire.”

Sales by geographical area at the end of December

At the end of December 2024, all the geographical areas posted growth. Hermès continued the qualitative development of its exclusive distribution network.

Asia excluding Japan (+7%) recorded a remarkable increase, thanks to solid sales in all the countries in the area. Growth reached 9% in the fourth quarter, despite the downturn in traffic in Greater China since the end of the first quarter. In China, the store in Shenyang’s MixC mall reopened in December after expansion work, following the Shenzhen Luohu store in October and the Beijing SKP store in May. In Singapore, the newly renovated and extended Takashimaya store also reopened in October.

Japan (+23%) achieved a regular and sustained growth, driven by the loyalty of local clients. A new store was opened in the Ginza district of Tokyo in June, following the Azabudai Hills store which opened in February.

The Americas (+15%) confirmed excellent growth in 2024. In the United States, the Atlanta store reopened in October after being renovated and expanded, following the April inauguration of the store in Princeton, New Jersey. An event showcasing the petit h creations was staged in New York’s Madison store in October.

Europe excluding France (+19%) and France (+13%) both performed well, supported by robust demand and the loyalty of local clients, as well as dynamic tourist flows. In November, a new store was inaugurated in Lille, after the June reopening of the renovated and expanded store in Nantes. The newly renovated and extended store in Naples reopened in December.

-

1. Presentation of the Group and its results

1.1Six generations of craftspeople

The Hermès adventure began in 1837 when the harness-maker Thierry Hermès opened a workshop in rue Basse-du-Rempart in Paris. Gradually, generation after generation, the House followed a dual thread – on the one hand the painstaking work of the craftspeople in his workshop, and on the other the active lifestyles of its customers. Carried by an enduring spirit of freedom and creativity, Hermès remains highly sensitive and attentive to the changing nature and needs of society.

In 1880, Charles-Émile Hermès, the founder’s son, moved the workshops to 24, rue du Faubourg Saint-Honoré, and set up an adjoining store. At this now-emblematic address, harnesses and saddles were made to measure. The business was already standing out for the excellence of its creations.

AN INNOVATIVE HOUSE PASSIONATE ABOUT ITS ERA

During the interwar period, lifestyles changed and the House broke new ground under the management of Thierry’s grandson, Émile Hermès. He decisively influenced the family firm’s destiny when, while travelling in Canada, he discovered the opening and closing system of an automobile hood. In 1922 he obtained exclusive rights to this American “universal fastener” – known today as the zip – which was used extensively in the House’s luggage and other designs. Under the impetus of Émile Hermès, the House opened up to other métiers, while retaining a close connection with the equestrian world, drawing on its mastery of raw materials and its artisanal culture to create its first ready-to-wear collections. In 1937, the famous silk scarf was born with the Jeu des omnibus et dames blanches design, the first in a long series.

Robert Dumas – one of Émile Hermès’ sons-in-law, who took the helm of the House in 1951 – was a regular visitor to the workshops and designed objects whose details (buckles, fasteners, saddle nails and anchor chains) exuded an elegance that in no way diminished their practicality. Hermès objects stand out for their noble materials, their mastery of savoir-faire, and their bold creativity, stimulated by the House’s keen vision of the world. The Silk métier now invites artists to create unique designs.

-

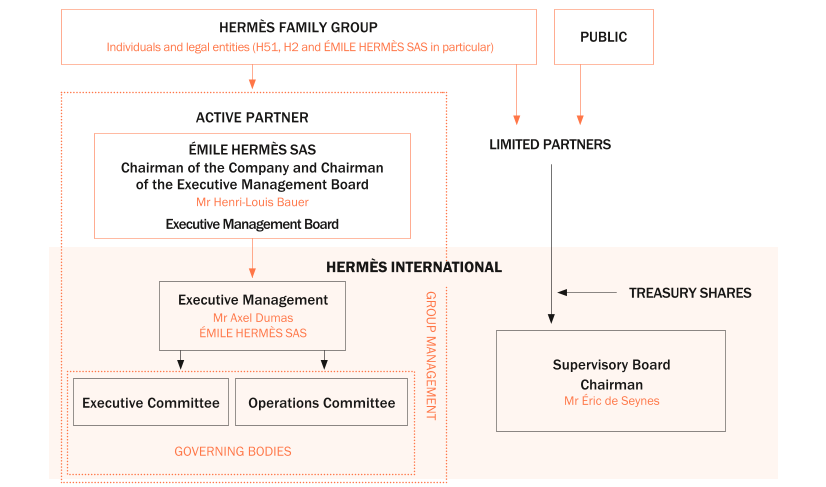

1.2Group governance

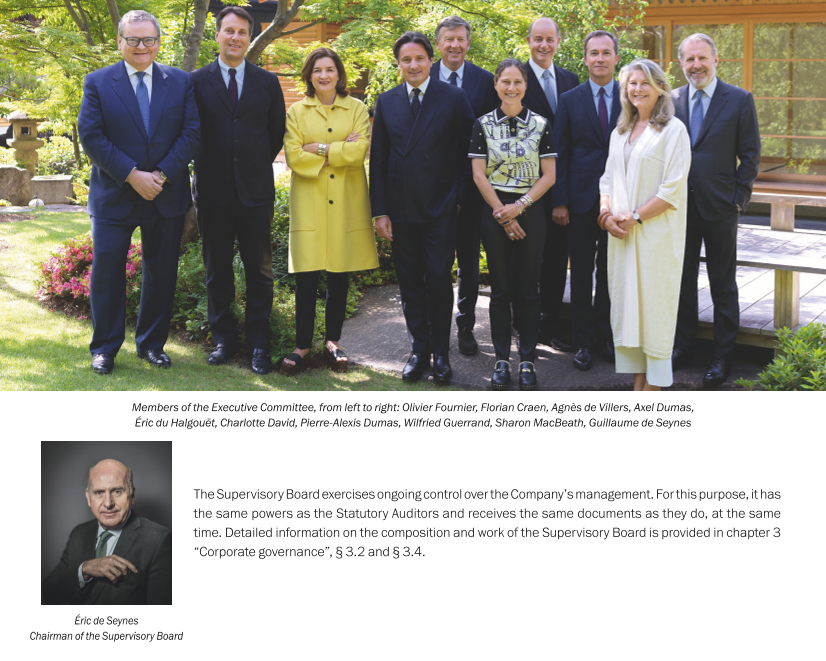

The Executive Management ensures the management of Hermès International. The role of Executive Chairman is to manage the Group and act in its general interest, within the scope of the corporate purpose and subject to those powers expressly granted by law or by the Articles of Association to the Supervisory Board, to the Active Partner and to Shareholders’ General Meetings.

The Executive Chairmen’s roles are distributed as follows: Axel Dumas is in charge of strategy and operational management, and Émile Hermès SAS, through its Executive Management Board, is responsible for vision and strategic priority areas.

The Executive Chairmen are supported in their management of the Group by the Executive Committee. This consists of Executive Vice-Presidents, each of whom has well-defined areas of responsibility. The role of the Executive Committee is to oversee the Group’s strategic and operational management. Its composition reflects the Group’s main areas of expertise.

The Operations Committee, which reports to the Executive Management, is made up of certain members of the Executive Committee and the Senior Executives of the main métiers and geographical areas, as well as the sales and support functions of the Group.

- ◆to involve Senior Executives in the Group’s major issues and strategic orientations;

- ◆to promote communication, sharing and reasonable exchanges amongst its members in their area of responsibility;

- ◆to enable the Executive Committee to take certain decisions.

-

1.3Strategy

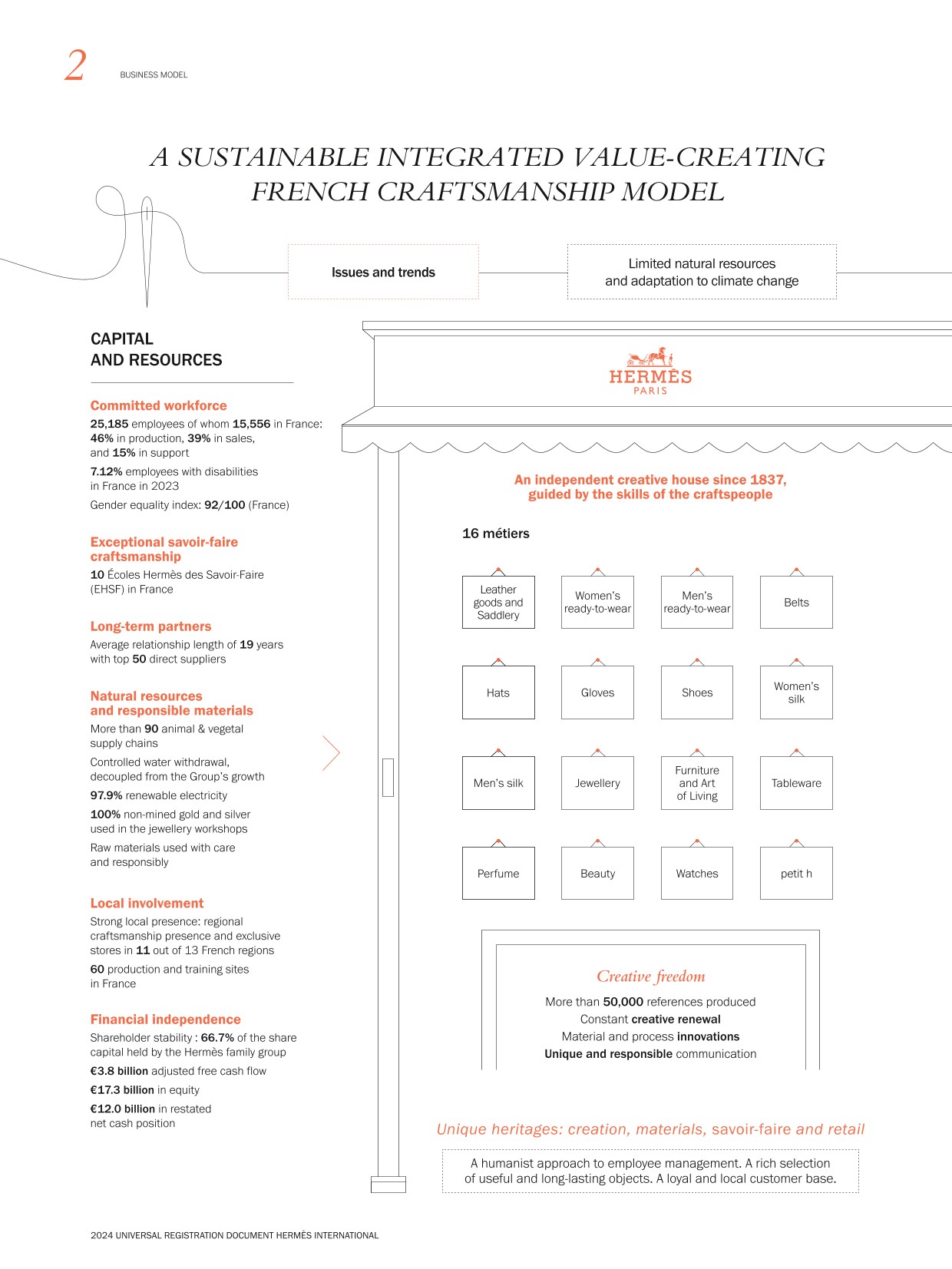

Hermès is an independent company backed by family shareholders. Its strategy is based on three pillars: creation, craftsmanship and an exclusive, balanced distribution network.

Since 1837, the Group has remained true to its values of freedom, demanding craftsmanship savoir-faire, authenticity and responsible growth. Its integrated craftsmanship business model places quality and sustainability at the centre.

In 2024, the House maintained its vision, preserving the major balances of the House, committed more than ever to respecting its values.

Creation at the core of Hermès' strategy

Hermès creates and manufactures quality objects designed to last, to be passed on from one generation to the next, and to be repaired. This approach requires these issues to be taken into account at every stage, from design to sales.

Hermès’ strategy is based on creative freedom. Each year, a theme inspires creators and Artistic Directors. Driven by a history spanning nearly 200 years, during which the House has continued to develop with audacity and ingenuity, Hermès paid homage to the theme of the Spirit of the Faubourg in 2024. This place, the result of a dream — that of Émile Hermès — is the beating heart of the House. It is found everywhere Hermès is located and infuses the effervescence and joyful spirit so dear to the House. High standards in design and manufacturing encourage the creation of objects that aim to surprise and amaze customers. This creativity, revolving around traditional savoir-faire, is coupled with innovative processes to revisit timeless models and create exceptional pieces, without departing from Hermès’ trademark humour and imaginative flair. The unbridled creativity flourishes in all métiers, as reflected in the numerous scarf designs printed every year. It is then expressed through over 50,000 references, developed around a unique identity and a style blending exceptional quality, innovation, surprise, elegance and simplicity. In 2024, it was expressed in particular with the successful launches of Barénia perfumes, a new feminine fragrance inspired by the House’s leather heritage, or Hermessence Oud Alezan. The Hermès Beauty métier completed the fifth chapter of Le Regard with the launch of Trait d'Hermès. New creations have met with great success, in the leather goods collections, alongside emblematic creations, such as the Haut à Courroies en selle, Della Cavalleria Élan and Arçon, Men's and Women's ready-to-wear or in jewellery, with the eighth Haute Bijouterie collection, Shapes of colour. In silk, the dynamic of formats, materials and creations continued to drive the collections.

-

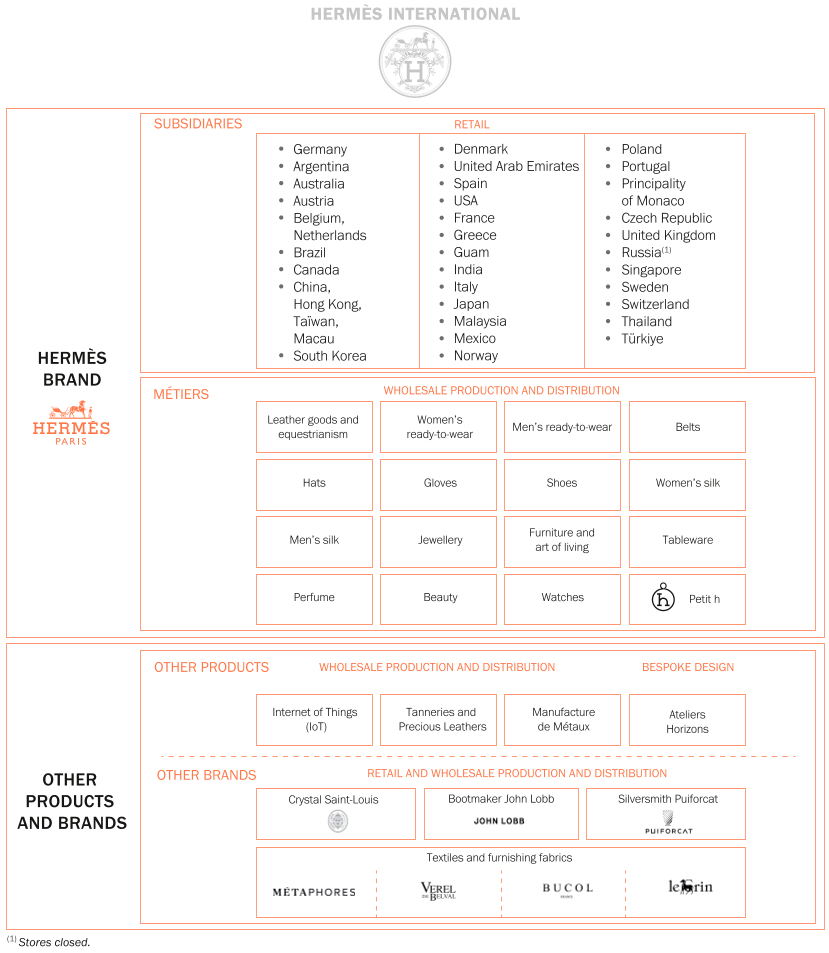

1.4Simplified organisation chart and Group locations

1.4.1Summary description of the Group as at 31 December 2024

-

1.5Key financial and non-financial figures AFR

1.5.1Revenue by métier for 2024 (2023)

-

1.6Revenue and activity by métier AFR

In millions of euros

2024

Mix

2023

Mix

Change

at current exchange rates

at constant exchange rates

Leather Goods & Saddlery

6,457

43%

5,547

41%

16%

18%

Ready-to-wear and Accessories

4,405

29%

3,879

29%

14%

15%

Silk and Textiles

950

6%

932

7%

2%

4%

Other Hermès sectors

1,909

12%

1,653

12%

16%

17%

Perfume and Beauty

535

4%

492

4%

9%

9%

Watches

577

4%

611

5%

(6)%

(4)%

Other products

337

2%

313

2%

8%

9%

CONSOLIDATED REVENUE

15,170

100%

13,427

100%

13%

15%

1.6.1Leather Goods & Saddlery

Leather Goods & Saddlery, Hermès’ original métier, groups together bags for men and women, travel articles, small leather goods and accessories, saddles, bridles, and a full range of equestrian products and clothing.

The Leather Goods & Saddlery métier represents 43% of consolidated sales. In 2024, it generated revenue of €6,457 million.

Hermès leather goods and saddlery objects are the result of a very special alchemy, based on a constant dialogue between designers and craftspeople, and the use of the finest materials, selected with the greatest care. The craftspeople use traditional savoir-faire, passed down from generation to generation. This patient daily dialogue with leather, crafted and fashioned by hand, gives these unique objects a distinctive additional measure of personality.

Leather goods and saddlery objects are made in nine centres of expertise that bring together production units, workshops and training centres in Paris, Pantin and six regions of France, together with a network of long-term French partners, selected with the greatest care to ensure respect for Hermès' unique craftsmanship savoir-faire.

To meet continued strong demand, Hermès is expanding its network of manufacturing sites each year in order to strengthen its production divisions. A new leather goods workshop was inaugurated in September 2024 in Riom (Puy-de-Dôme). Hermès also continued preparing for the construction of three future production units, which are scheduled to open in 2025 in L'Isle-d'Espagnac (Charente), 2026 in Loupes (Gironde) and 2027 in Charleville-Mézières (Ardennes). Each new establishment is set up in close collaboration with local stakeholders, administrative and economic development bodies. In this way, Hermès reaffirms its commitment to regions with a strong manufacturing savoir-faire and its will to provide high-quality jobs. Proud to contribute to the expansion of sectors of excellence in France, Hermès thus maintains long-term relationships with its suppliers and partners, with loyalty and high expectations, to maintain the unique qualities of a Hermès object: exceptional materials, training in savoir-faire and dedicated workshops.

The House also places great importance on constantly perfecting the skills and savoir-faire of its craftspeople through a range of training and professional qualification programmes. These programmes are delivered within the École Hermès des Savoir-Faire and through multiple partnerships with training structures in the regions concerned. Since 2024, the École Hermès des Savoir-Faire has been present in each of the nine manufacturing divisions.

1.6.1.1Women’s bags

The equestrian world continues to inspire new designs in 2024. The Hermès Della Cavalleria line, which turns the horse's bit into a clasp, has a new day-to-day Elan format. The Arçon bag, whose rounded contours evoke the curves of a saddle, is given a more compact everyday format, the P'tit Arçon.

In Fashion accessories, the Collier de chien story introduces the Médor line, which showcases the pyramid stud in a diabolo format, the Mini Médor.

The emblematic models continue their metamorphosis: the Kelly bag further extends its family with two new formats, the Kelly Move, a small everyday bag, and the Kelly Jump, a small urban backpack. As for the Constance, it has a very feminine elongated Elan format, for both day and evening.

The quest for the exceptional continues to be expressed through the implementation of numerous elements of savoir-faire that push the limits of creation, in an Arts & Crafts spirit. Corner stitching, lacing and leather braiding are featured on the Sabot bag, whose shape is inspired by a horse’s hoof and whose Pluch version is adorned with merino sheepskin. For the first time, wood marquetry is applied to leather goods with the addition of a small wooden horse to the body of the Kelly Mini and the Kelly Elan. A nod to parade saddles, a story of studs is told on the Constance Mini and Kelly Mini bags, whose bodies are set with hundreds of studs. Finally, the emblematic Bolide is reinterpreted using thread embroidery that draws the Selle Imaginaire pattern all over the bag, or by a set of printed, applied and stitched patches on the body of the bag.

1.6.1.2Men's bags

The men's collections confirm their dynamism and bring in new styles designed to meet contemporary needs. Alongside the indispensable Haut à Courroies and Kelly, the emblematic Bolide bag is reinterpreted in an urban format to be worn hands-free, the Bolide à dos, while retaining its signature codes and savoir-faire. Also in tune with the times, the Cab'H is the first full leather tote bag for men. Vertical and functional, it is signed with equestrian-inspired details.

The Haut à Courroies bag unveils exceptional Arts & Crafts versions using unprecedented constructions and savoir-faire: layering of pockets of various sizes for the Haut à Courroies Multipockets, and colour work in the tannery for the Coup de soleil version, on which certain details appear to have left their mark after exposure to the sun.

1.6.1.3Travel

The R.M.S suitcase odyssey continues in 2024: it now extends its presence to all stores worldwide. New colourful, joyful prints adorn the collection, such as the Bel Oasis pattern, showing a horse quenching its thirst in the middle of cacti in the desert, or the emblematic Quadrige. The exceptional is also invited into the R.M.S universe with the Cargo suitcase, a real globetrotter’s delight with its multiple pockets. Finally, two travel bags in 12- and 72-hour formats complete the R.M.S collection to offer each trip its companion bag.

1.6.1.4Accessories and small leather goods

The collections of small leather goods are constantly expanding and being renewed in order to provide the perfect response to changes in uses in each market.

The range of everyday objects to be worn hands-free and boasting bold silhouettes continues to expand with new contemporary styles, such as the Hermèsnap with its refined profile and a rich colour palette for men, or the very feminine Sursoie To Go, which puts silk in the spotlight with joyful designs and bright colours.

This year, the H Sellier men's line of essential formats welcomes a new card holder with numerous features.

To celebrate the annual theme, the Reading & Writing universe completes its stationery offering with a new illustrated notebook Carnet de notes in the colours of the Faubourg, while the book “24 Faubourg Saint-Honoré” by Frédéric Laffont presents many tales and anecdotes about this historic seat of the House.

Finally, fantasy continues to be expressed through various objects such as the hands-free Hermès Nestor card holder, with a mischievous dog drawn on the flap, or the Bolide Shark charm, an actual functional and playful miniature version of the eponymous bag designed in 2016.

1.6.1.5Materials

Since its founding, Hermès has never ceased to explore and create materials to enhance the aesthetics, functionality and sustainability of its objects, while continuing to respond to the desires and uses of the present time.

2024 was marked by the introduction of a luminous material, Chamkilight goatskin. The delicate grain of this hide is enhanced by a subtle transparent golden glow, achieved thanks to the perfect application of a new generation of metallic pigments. In this way, Chamkilight goatskin brings an unprecedented dimension to the Kelly Mini and Constance Mini bags.

The range of colours has also been enhanced with new timeless and seasonal shades. A tribute to the talent of Hermès as a colourist, they play with light and combine with materials in an infinite field of exploration: the vivacity of Orange Field on Mysore goatskin or the felted depth of Gris Misty on Clémence bull calfskin, echo the delicacy of the pastel tones of Rose Darling on Milo lambskin or the summer freshness of Vert Peppermint on Swift calfskin.

Silk prints are in the spotlight this year on a series of objects that reveal the richness of their designs and colours, and give them another dimension in volume: the line of small summer Balusoie bags, and in Small Leather Goods, the Avecsoie bottle-carrier, the Sursoie To Go pouch and the Avecsoie pocket cases.

1.6.1.6Equestrianism

Through the transmission of the excellence of its savoir-faire, the search for exceptional materials, innovation for the well-being of the horse and the daily support of the House’s partner riders – four of whom belong to the top 10 worldwide – and their mounts, Hermès reaffirms its commitment to its first customer, the horse, up to the highest sporting level.

In 2024, the Hermès saddle thus reached the world’s most prestigious podiums and added new titles to its list of wins, notably with Jessica von Bredow-Werndl and TSF Dalera BB in the Hermès Arpège saddle, Ben Maher and Dallas Vegas Batilly in the Hermès Vivace saddle, and Steve Guerdat and Dynamix de Belhème as well as Simon Delestre and I Amelusina R 51 in the Hermès Cavale saddle.

2024 also marks the expansion of the collection of objects dedicated to horses, with the customisable ergonomic bridle II, the felt and leather Equi'libre shock absorbing pad which guarantees an optimal fit between the rider and his or her mount, and the Derby saddle pad with quilted lines reminiscent of the Rocabar pattern.

-

1.7Revenue and activity by geographical area AFR

In millions of euros

2024

Mix

2023

Mix

Change

Change at current exchange rates

Change at constant exchange rates

Europe

3,594

24%

3,093

22%

16%

17%

- ◆France

1,447

10%

1,274

9%

14%

13%

- ◆Europe (excluding France)

2,147

14%

1,818

13%

18%

19%

Asia-Pacific

8,085

53%

7,533

57%

7%

10%

- ◆Japan

1,437

9%

1,260

10%

14%

23%

- ◆Asia-Pacific (excluding Japan)

6,648

44%

6,273

47%

6%

7%

Americas

2,865

19%

2,502

19%

15%

15%

Other (Middle East)

627

4%

299

2%

110%

110%

Consolidated revenue

15,170

100%

13,427

100%

13%

15%

1.7.1Europe

In France, Hermès reaffirmed its commitment to the regions through the reopening of two stores. First in Nantes, where the store located in the heart of the spectacular Passage Pommeraye since 2011 reopened in June after being completely renovated. Its single-storey space invites visitors to explore all of the House’s métiers in a warm and natural atmosphere, where wood is omnipresent. Numerous elements pay tribute to this passage, which is classified as a listed historic building, from the high windows reminiscent of the vaulted glass roof, to the acanthus leaf that is reminiscent of the original ornaments of the site, through a selection of works related to the industrial, maritime and cultural heritage of the regional capital.

In November, the Lille store, where the House has been present since the 1950s, reopened after moving. The larger store is located on rue des Chats-Bossus, in the heart of Vieux-Lille, in a group of two 15th and 16th-century houses, a listed historic building, with an interior courtyard and a garden. The collections of the House’s métiers are spread over two levels, across different spaces with distinct identities. The interior design multiplies the play of light, fabrics and colours typical of Lille’s homes. In line with the House’s responsible commitment, several local craftspeople contributed their expertise to the restoration of the premises.

The year was also marked by many events. In January, the palais d'Iéna hosted the fashion show for the fall-winter 2024 men's ready-to-wear collection, while the collège des Bernardins served as the setting for the press presentation of the new Tressages équestres tableware. The month of March saw the fall-winter 2024 women’s ready-to-wear collection fashion show at the Garde Républicaine, then the 14th edition of the Saut Hermès. Organised under the framework of the Grand Palais éphémère, this international CSI 5* competition brought together 25 riders of 15 nationalities, as well as 130 horses. Over three days, spectators were enthralled by the 10 sporting events, immersed themselves in the world of horses and discovered Hermès’ savoir-faire.

The arrival of summer was celebrated by the spring-summer 2025 men's ready-to-wear collection fashion show at the palais d’Iéna, as well as by the presentation of the new Hermès haute bijouterie collection, Les Formes de la Couleur. Unveiled at the end of June in the prestigious setting of the Musée des arts décoratifs de Paris, the collection lit up the Faubourg Saint-Honoré store with its bold colours until mid-July, before setting out on its tour. It was also in June that the Le Monde d’Hermès kiosk made a stopover in Nice, on the promenade du Paillon, before heading to Aix-en-Provence in July. Inspired by Parisian newsstands, this colourful display dedicated to the House’s magazine invited tourists and walkers to soak up the spirit of the Faubourg and the fantasy of Hermès. At the end of September, at the Garde Républicaine, the spring-summer 2025 women’s ready-to-wear collection fashion show brought a little warmth to the beginning of the fall.

Elsewhere in Europe, several key moments were also organised. In April, Hermès imagined an exclusive scenography as part of the Watches & Wonders Trade Show in Geneva, to present its new Hermès Cut watch and continue to illustrate its unique approach to time. In Berlin, a fun and quirky Dîner de l’Encravaté put the spotlight on ties in front of the press and influencers. Also in April, Milan Design Week was an opportunity to highlight the latest creations from the Home universe, Métaphores textiles and Cristalleries Saint-Louis. In December, Italy also celebrated the reopening of the store located in Via Filangieri, in the Chiaia district of Naples since 2002. Behind its high-windowed Art Nouveau façade, the store unveils an enlarged and entirely renovated interior space, where the collections are displayed in a colourful environment, a tribute to the landscapes of the Bay of Naples.

-

1.8Comments on the consolidated financial statements AFR

1.8.1Income statement

In millions of euros

2024

2023

Revenue

15,170

13,427

Cost of sales

(4,511)

(3,720)

Gross margin

10,660

9,708

Sales and administrative expenses

(3,569)

(3,169)

Other income and expenses

(942)

(889)

Recurring operating income

6,150

5,650

Other non-recurring income and expenses

-

-

Operating income

6,150

5,650

Net financial income

283

190

Net income before tax

6,432

5,840

Income tax

(1,845)

(1,623)

Net income from associates

44

105

Consolidated net income

4,631

4,322

Non-controlling interests

(28)

(12)

Net income attributable to owners of the parent

4,603

4,311

In 2024, the Group’s consolidated revenue amounted to €15.2 billion, up 15% at constant exchange rates and 13% at current exchange rates compared to 2023.

The gross margin rate reached 70% in 2024, compared to 72% for the 2023 financial year, which benefited in particular from the positive impact of foreign exchange hedges.

Sales and administrative expenses, which represented €3.6 billion (€3.2 billion in 2023), notably included €637 million in communication expenses (€607 million in 2023). Other sales and administrative expenses, which mainly include the salaries of sales and support staff as well as variable rents, amounted to €2.9 billion (€2.6 billion in 2023).

Other income and expenses amounted to €942 million (€889 million in 2023). They include depreciation and amortisation of €693 million (€604 million in 2023), half of which relates to property, plant and equipment and intangible assets and the other half to right-of-use assets. Other expenses also include €180 million related to free share plans in 2024 (€151 million in 2023).

Recurring operating income amounted to €6.2 billion, up by 9% compared to 2023. Recurring operating profitability, despite the negative impact of exchange rates, reached 40.5% of sales compared to 42.1% in 2023, an exceptionally high level.

-

1.10Outlook AFR

On the strength of its unique business model, based on its values of independence, entrepreneurial spirit, craftsmanship and creativity, Hermès has shown the solidity of the House's craftsmanship and entrepreneurial business model, with excellent results in 2024, despite a more uncertain economic and geopolitical context. All geographical areas grew. All métiers, except Watches, continued to make solid progress, reflecting the desirability of creations among its customers. Hermès, firmly rooted and inspired by its heritage, is enriched by its creative freedom and innovation, and its attachment to savoir-faire. Firmly believing that there can be no creation of economic value and long-term development without creation of social and societal value and without environmental responsibility, Hermès is committed to leaving a positive footprint on the world.

Thanks to the ongoing dialogue between creation and excellence in savoir-faire, the House will continue to blossom, affirming the uniqueness of its style. The year 2025 will be marked by the development of new collections based on the most beautiful materials and an abundant creativity. Among the new products, the Perfume and Beauty métier will launch two new Eaux de Parfum Intenses, first for Terre d’Hermès in the first half of the year, before Barénia in the autumn. Watches will continue to roll out its Kelly and H08 lines, which are expanding rapidly, and will present its new products at the Watches & Wonders Salon in Geneva. As part of Milan Design Week, Hermès will present the new collections of the Home universe and will in particular launch the Hermès en contrepoint tableware. The emblematic bags Picotin and Evelyne, with new ways of being worn and uses, will enrich the Leather Goods collections alongside new creations.

The integrated and exclusive distribution network will continue to strengthen its omnichannel offering. In order to nurture the link with its particularly loyal local customers and to attract new customers, special attention will continue to be paid to the digitisation of uses, the development of services and the expansion of the online product offering. The qualitative development of the store network will continue in 2025, notably with projected openings in Phoenix and Nashville in the United States and Taipei in Taiwan. Priority will continue to be given to the expansions and renovations of around 15 branches around the world, notably in Florence (Italy), Seoul (Korea) and Bangkok (Thailand). In addition, investments will continue for the new London store in New Bond Street, with an opening scheduled for 2026.

In light of with the House’s strong momentum, the development of production capacities will continue in all métiers, and in particular in Home and Perfume, with the finalisation of the construction of a new production cellar in Vaudreuil. The growing demand in Leather Goods & Saddlery will be supported by the ramp-up of new sites. Discussions are underway concerning the opening of a 10th expertise hub by 2028 to strengthen the local presence spread throughout France. The Group will continue its objective of opening on average one production unit per year, representing around 300 new hires. In 2025, Hermès will inaugurate a new leather goods workshop in Isle-d'Espagnac in the Charente region, on the brownfield site of the former Bel-Air aerodrome, in compliance with its responsible real estate standards. It will join the South-West division, which already includes the Montbron and Nontron leather goods workshops and the Saint-Junien leather goods and gloves workshop, which have been present in the region for more than 25 years. The projects of the Loupes (Gironde) and Charleville-Mézières (Ardennes) leather goods workshop projects, scheduled for 2026 and 2027 respectively, will continue. Hermès will strengthen its integration in France in regions with high manufacturing savoir-faire and develop employment and training. The House’s other métiers will continue to use their extensive expertise to design and create exceptional objects. Overall, operational investments should amount to €1 billion in 2025.

True to its commitment as a responsible employer, with the creation of nearly 7,000 jobs over three years, of which more than 65% in France, Hermès will continue this multi-local and multi-métier dynamic in 2025. The Group will step up its efforts in terms of social, societal and environmental performance. Hermès will pursue its commitment to the development of its employees, inclusion and diversity. The House will also launch work to formalise its major social commitments through the drafting of several policies on the themes of dialogue with our employees, working conditions, diversity and inclusion.

The enhancement and transmission of savoir-faire will remain at the heart of the priorities of the métiers, with, in particular, the ramp-up of the apprentice training centres (CFA) dedicated to the leather goods métiers, as well as the House's training in the unique savoir-faire of the other métiers, such as Jewellery. Present today in 10 regions, the École Hermès des Savoir-Faire will gradually be set up in all the regional Leather Goods divisions.

Control of the supply chains, guaranteeing the quality of materials, will continue with the implementation at the House’s partners of CSR briefs, supply chain briefs and a responsible purchasing policy, which bring together the Group’s requirements notably in terms of traceability, certification, carbon trajectory, reduction of water consumption and respect for human rights.

The House’s commitments to fighting climate change and the preservation of biodiversity will remain at the forefront. With the development of eco-design strategies for all métiers and the construction of an internal tool to make life cycle analyses systematic, the Group will continue its efforts to encourage the sparing use of resources and waste management. More broadly, the Group’s actions in favour of biodiversity will be strengthened by the continuation of the Science Based Targets for nature (SBTN) initiative with the setting of targets as provided for in step 3 of the framework, and the deepening of impact analyses using the Global Biodiversity Score (GBS) method.

In line with its climate change mitigation commitments, the Hermès Group will continue its actions in accordance with its reduction objectives, approved by the Science Based Target initiative (SBTi), to reduce scopes 1 and 2 emissions by 50.4% in absolute value and scope 3 emissions by 58.1% in intensity, over the 2018-2030 period. In 2025, the Group will prepare the update for the SBTi and will work on the formalisation of its long-term objectives, which will make it possible to comply with the “net zero” standard of this same initiative. Work will also be undertaken in 2025 to identify the expenses, investments and financing specifically related to the implementation of the transition plan. The particularly demanding responsible construction framework will continue to be rolled out for new real estate projects. At the same time, Hermès will increase its contribution to projects with a strong environmental, social and economic impact outside its value chain, in particular through the Livelihoods Carbon Funds. The House will also continue undertaking studies for projects within its value chain, in order to prepare for the neutralisation of its residual emissions. In terms of adaptation, the results of a new analysis of climate risks conducted on the sites and the main international flows will provide a comprehensive view of the risks at all of the Group’s sites

Hermès will strengthen its role as a responsible company alongside its suppliers, which it will continue to support, with the rollout of its Supplier code of conduct, and with the communities in which it operates, whether through site openings, job creation, the development of vocational training centres for its craftsmanship métiers, and contributions to the social and cultural life of the regions.

The Group is looking forward to 2025 with confidence, thanks to its highly integrated craftsmanship model, its balanced distribution network and the loyalty of its customers.

In the medium term, despite the economic, geopolitical and monetary uncertainties around the world, the Group confirms an ambitious goal for revenue growth at constant exchange rates. Thanks to its unique business model, Hermès is pursuing its long-term development strategy based on creativity, maintaining control over savoir-faire and singular communication.

-

1.11Fondation d’entreprise

Driven since 2008, the year of its creation, by the humanist values of the House from which it emanates, the Fondation d’entreprise Hermès carries out its philanthropic actions in ways that set it apart from the French philanthropic landscape. It has chosen to be an operator rather than a distributor, by developing specific programmes in four areas: the creation of new works of art, the transmission of skills and expertise, the protection of biodiversity and solidarity. Through each of its programmes, the Foundation strives to act as effectively as possible, on the ground, in response to targeted needs. Whether they are artists, project leaders or students, the beneficiaries of these actions can thus experience very concretely how the Foundation contributes, on its own scale, to building a better world.

In 2024, the Foundation focused on outreach, with the solidarity actions that are inherent in its commitments. Intended for Hermès employees worldwide, the internal H3 - Heart, Head, Hand programme, launched in 2013, is based on the conviction that those who work within the House share its humanist values. Thus, each employee can propose to the Foundation a solidarity organisation engaged in one of its fields of action so that it can benefit from financial support. In 2024, this programme was the subject of an internal campaign resulting in a large number of applications: 14 projects were selected and financially supported by the Foundation, each time with the involvement of the employee, who assumes the role of ambassador. Launched in 2023, skills-based patronage - another support mechanism set up with the help of the Group’s human resources department - increased in scale this year. Within this scheme, everyone can get involved on the ground with a local solidarity organisation, during their working hours. This format facilitates the concrete efforts of those who wish to take action to benefit a solidarity-based initiative.

Solidarity is also one of the drivers of transmission, as evidenced by the Artists in the Community scholarship scheme - a pivotal element of the Foundation’s eponymous programme. In 2024, it funded 119 scholarships to support students enrolled in one of the 20 partner educational establishments and ensure that these young talents can devote themselves fully to their demanding training in dance, theatre, circus and, for the first time, puppetry arts. At the same time, the Foundation invited the third class of these scholarship artists to present a collective post-diploma project, Transmission Impossible, at the Avignon Festival, under the direction of choreographer Mathilde Monnier. One way to support them as they take their first professional steps.

The Foundation is also keen to promote transmission between professionals in a dynamic of collective intelligence: this is the challenge of the Académie des Savoir-Faire. In 2024, the Foundation published the encyclopaedic book Savoir & Faire - La Pierre co-published with Actes Sud, which completes the Academy dedicated to this material in 2023. It also launched a call for applications for the seventh edition of the programme, this time dedicated to paper, which will open in 2025 under the direction of French designer Constance Guisset.

Lastly, the Manufacto programme pays special attention to school children, and has been committed to the transmission of craftsmanship savoir-faire in schools since 2016. More than 2,400 pupils aged from nine to 15, from 16 academic regions, have been familiarising themselves with the leatherwork, saddlery-upholstery, carpentry or plastering know-how under the supervision of a craftsperson since the start of the 2024 school year.

Using the same model, the Manuterra programme, created in 2021, allows pupils to discover gardening savoir-faire during school time. Since the start of the 2024 school year, 850 pupils aged from nine to 15, from 10 academic regions, have been cultivating a plot using permaculture techniques in order to learn about issues related to ecosystem preservation. In addition to this educational initiative, which is managed with the partner academic regions, the Foundation strives to act on other levers to help protect the living world by supporting various large-scale projects as part of the Biodiversity & Ecosystems programme.

The Fondation d’entreprise Hermès remains very committed to the field of creation, particularly performing arts. Launched at the Théâtre de la Cité Internationale in Paris in 2023, the performing arts festival Transforme completed its first season in 2024 after continuing its programming at La Comédie in Clermont-Ferrand, the SUBS in Lyon and the Théâtre national de Bretagne in Rennes, attracting a total of 18,000 spectators. In October 2024, the Foundation launched the second edition of Transforme, again at the Théâtre de la Cité Internationale in Paris, in the presence of a large audience.

The Foundation is also very active in the field of visual arts: in 2024, 11 exhibitions have been organised in the galleries for which it is responsible for artistic programming, in Brussels (Belgium), Saint-Louis-lès-Bitche (France), Tokyo (Japan) and Seoul (South Korea).

In addition, 2024 will have been a year of transition for the Artists' Residencies in the Hermès production units: closing the cycle of residencies mentored by Gaël Charbau, the visual artist Linda Sanchez was invited to the Cristallerie Saint-Louis to create a work by drawing upon the exceptional savoir-faire of the master glassmakers. At the same time, a new cycle began, under the artistic direction of Emmanuelle Luciani: the latter invited Jenna Kaës to the Maroquinerie de la Tardoire and Mounir Ayache to the Holding Textile Hermès (HTH), to create a work with the involvement of Hermès' craftspeople.

In the field of contemporary photography, the Immersion programme, a Franco-American photographic commission, closed with the exhibition in Paris of the work of its final laureate, the American photographer Raymond Meeks: presented at the Fondation Henri Cartier-Bresson, his series “The Inhabitants” was published in co-edition with Mack Books.

Throughout its programmes, the Fondation d’entreprise Hermès conducts its patronage by supporting women and men who act in favour of the public interest and with whom it shares a common humanist purpose. Thus, it continues, with ambition and responsibility, to cultivate collective intelligence and to combine progress and the common good, in order to put people back at the heart of our society.

The activity report of the Fondation d’entreprise Hermès can be found in full at: https://www.fondationdentreprisehermes.org/en, section “the Foundation”.

1.Stores closed. -

2. Corporate social responsibility and non‐financial performance AFR

Hermès wishes to advise the reader of the inherent limits of forward-looking statements as well as the proper understanding of the concepts of materiality or significance, in the specific context of this sustainability report (see “Disclaimer, page 195 of this document”).

2.1Sustainability information

2.1.1General disclosures (ESRS 2)

2.1.1.1Reporting basis (BP-1 AND BP-2)

Preparation context

The sustainability disclosures have been prepared as part of the first-time application of legal and regulatory requirements following the transposition of the European Corporate Sustainability Reporting Directive ("CSRD").

This first year of implementation of the CSRD is marked by many uncertainties. In addition to those inherent in the state of scientific or economic knowledge as well as the quality of the external data used, several interpretations of the texts remain, for which additional clarifications from the standardisation or regulatory bodies are expected, in particular concerning sector-specific standards for the application of the ESRS or the application of the technical criteria of the Taxonomy Regulation.

The Group has therefore endeavoured to apply the normative requirements set by the ESRS, as applicable at the date of preparation of the sustainability report, on the basis of available information (for example, information required on policies, actions, measures or objectives), within the deadlines for preparing the sustainability statement.

The preparation of sustainability information was also complicated by the absence of comparative data and reliable benchmarks, in particular at sector level, as well as by difficulties in collecting market data, particularly within the value chain.

In some cases, these difficulties in accessing reliable data have forced us to use estimates, which it should be possible to refine as the quality of the available data improves.

Scope of the sustainability report

The sustainability report corresponds to section 2.1 "Sustainability information”. The scope of this sustainability report covers all of the Hermès Group operations, including all sites, métiers and subsidiaries, as well as all regions, the scope of which is detailed in chapter 1 “Presentation of the Group and its results”, § 1.4. The scope of consolidation used for this sustainability report is identical to that of the consolidated financial statements, with the exception of companies consolidated by the equity method which are not included and have been deemed non-material as regards sustainability matters.

The entities consolidated during the year are part of the reporting scope, with the exception of certain indicators for which the limitations of the scope of collection applied on a case-by-case basis on certain data are explained in the sub-section relating to this data.

This sustainability report covers the Group’s entire value chain as well as its business model, as presented in § 2.1.1.5.

Social information

Environmental information

Governance information

12-month reporting period

01/01-31/12

01/10-30/09

01/01-31/12

Environmental information is collected on an annual basis that closes at the end of the third quarter to allow for timely consolidation and analysis of data. There were no significant events in the fourth quarter of 2024 that would call into question the significance of these data compared with an analysis based on a financial year.

In the context of this sustainability report, Hermès did not use the option to omit specific sensitive information (in accordance with ESRS 1, section 7.7, and Article 19a, paragraph 3 and Article 29a, paragraph 3 of Directive 2013/34/EU).

Time horizons

In accordance with ESRS 1, Hermès assessed the time horizon of occurrence of each IRO whenever the IRO in question was “material”, both in terms of impact materiality and financial materiality. The thresholds were set in accordance with the implementation guidelines published by EFRAG:

●short-term (ST): one year (“the period adopted by the company as the reference period in its financial statements”);

Hermès uses the same definitions throughout the report, in particular for the expected figures and for the objectives relating to different time horizons.

Value chain estimates and sources of uncertainty associated with estimates and results

The sustainability information may be subject to inherent uncertainty due to the state of scientific and economic knowledge and the quality of internal and external data used (data calculated for the value chain, for example). The subject of estimates concerning the value chain is addressed in two thematic standards, namely § 2.1.2.1.7 (E1 standard - scope 3 data) and § 2.1.2.4.2 (E4 - biodiversity). In addition, the quantification of certain sustainability information, in particular environmental information, is subject to estimates and judgements based in particular on the Group’s experience and internationally recognised sustainability standards as well as the best information available to date. These estimates are sensitive to methodological choices and the assumptions used to prepare them. The nature and scope of the estimates used are as follows:

The Group uses estimates to calculate indirect greenhouse gas emissions (scope 3): (i) for estimating activity data, and (ii) for estimating emission factors, as described in § 2.1.2.1.7.

The Group also uses estimates to report data on substances of very high concern, as described in § 2.1.2.2.7.

With regard to biodiversity, Hermès wanted to shape its approach to reducing its impacts on biodiversity using the framework built by the SBTN approach. It is with this in mind that the Group has chosen to align biodiversity reporting with the method used to manage the subject operationally in the Group’s entities. SBTN steps 1 and 2 enabled Hermès to assess the biodiversity of its production sites using two tools (STAR and BII); Hermès is publishing the results obtained from these tools in order to meet the expectations of the E4 standard regarding the identification and prioritisation of sites in biodiversity-sensitive areas. More precise information on these two tools as well as on the results obtained, their processing and their use is available in § 2.1.2.4.2. The Group will monitor future advances in biodiversity-related tools and may develop its work accordingly

Elements of progressivity

In the context mentioned in the introduction, the Group has initiated work that it will continue in the coming years.

The transition plan was drawn up in the following context: SBTi validated the emission reduction objectives for scopes 1, 2 and 3 (horizon 2030) at the end of 2021, based on a reference year of 2018, including a reduction objective for the relative value of scope 3 emissions, whose objective is to contain global warming “well below 2°C”, in accordance with the SBTi sector recommendations at the time of its certification. There is no scope 3 emission reduction objective in absolute value as of this date. Thus, Hermès presents in its sustainability report targets for 2030 and does not present targets for 2050, in line with the SBTi objectives. Moreover, Hermès is not in a position to communicate the consolidation of the quantification of decarbonisation levers for scope 3 emissions implemented and planned in the various Group entities.

Hermès is working on the formalisation of its objectives, which will enable it to comply with the “net zero” standard in accordance with the expectations of the CSRD and will submit a new file to the SBTi in 2025. The physical risk analyses carried out by Hermès will also be supplemented in order to use more pessimistic scenarios.

Hermès has also indicated in this sustainability report that it is not able to quantify certain data points: on the planned cancellation of carbon credits (E1-7 AR 64), on inflow resources (E5-4-31), on the total amount of fines, penalties, and compensation for damages as a result of incidents and complaints relating to discrimination and harassment (S1-17-103c), on the prevention of corruption (G1-3-21b) and on payment terms (G1-6-33b). These data points do not contain any material information likely to influence the reader’s judgement. Capital expenditure (CapEx) and operating expenses (OpEx) related to action plans that are not disclosed in this document are not material from the point of view of the Group.

Lastly, to take into account the best practices and recommendations of the market as well as better knowledge of these new regulatory and normative provisions, the Group may be required, where necessary, to change certain reporting and communication practices, as part of a continuous improvement approach.

Information incorporated by reference

Data points

Reference document

Document section

ESRS 2 - GOV 1

Universal registration document

Chapter 3, § 3.3 “Administrative and management bodies” and § 3.4 “Organisation of the Supervisory Board”

ESRS 2 - GOV 3

Universal registration document

Chapter 3, § 3.8.2 “Overview of compensation and benefits of all kinds for Corporate Officers”

ESRS 2 - SBM 1

Universal registration document

Chapter 1, § 1.5 “Presentation of the Group and its results”

ESRS 2 - SBM 1

Universal registration document

Chapter 1, § 1.4 “Presentation of the Group and its results”

ESRS 2 - SBM 1

Universal registration document

Chapter 1, § 1.4 “Presentation of the Group and its results"

ESRS E1-1

Universal registration document

Chapter 5, § 5.6 “Consolidated financial statements AFR”

TAXONOMY

Universal registration document

Chapter 4 “Changes in complexity and interpretation of tax regulations”

ESRS S2-4

Universal registration document

Chapter 4, § 4.1 “Factors and management AFR”

ESRS S3 - 1

Vigilance plan

Chapter 3 – "Human rights and fundamental freedoms"

ESRS G1 - 4

Universal registration document

Chapter 6, § 6.7 “Parent company financial statements AFR”

2.1.1.2Sustainability governance (GOV 1 AND GOV 2)

2.1.1.2.1Composition of executive and supervisory bodies

Hermès, present throughout the world, is an independent House supported by family shareholders, a sign of stability and longevity.

The House benefits from an experienced and balanced governance, allowing proper consideration of sustainability matters and issues in its strategy.

Hermès details the composition and role of its administrative, management and/or supervisory bodies in chapter 3 "Corporate governance", § 3.2. The cross-reference table below highlights the sections relating to the information covered in § 2.1.4.1.3.

Executive Management assisted by its Executive Committee

Supervisory Board

GOV-1-21-a - Membership and composition

§ 3.3.1 and § 3.3.3

§ 3.4.5

GOV-1-21-b - Employee representation

Not applicable

§ 3.4.5

GOV-1-21-c - Experiences and expertise

§ 3.3.3.1.2

§ 3.4.5.2

GOV-1-21-d - Gender diversity and other diversity indicators

§ 3.3.4

§ 3.4.3

GOV-1-21-e - % of board members who are independent

Not applicable

§ 3.4.3.2

2.1.1.2.2Monitoring of sustainability impacts, risks and opportunities (IRO) by management and supervisory bodies

At Executive Management level

The Executive Management plays an active role in the operational implementation of the policies, actions and results associated with Impacts, Risks and Opportunities (IRO). In 2024, several joint sessions with the Group’s Executive Committee were held to validate the main strategic orientations relating to the IROs that were material for the Group, monitor the objectives and associated results, and ensure that the resources allocated were appropriate.

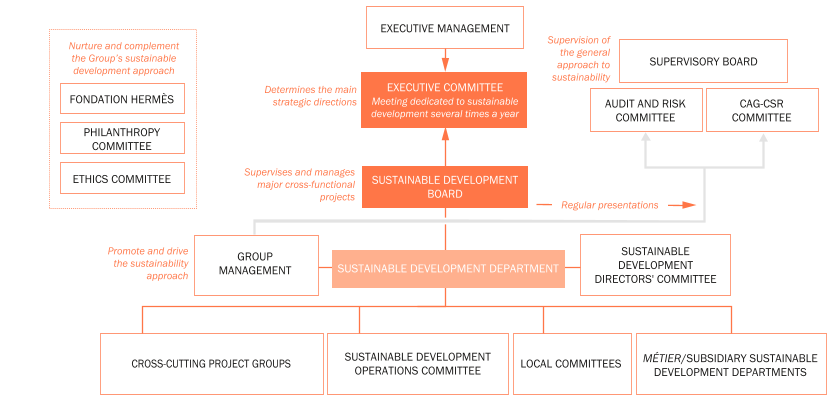

The Sustainable Development Board comprises directors of the Group’s main central functions and integrated supply chains. This Board oversees the implementation of the CSR approach, steers major cross-functional projects, oversees the roadmaps of the House’s main entities, launches and monitors ad hoc working groups, and identifies key decisions to be submitted for approval to the Executive Management and its Executive Committee.

To complement the Board’s functions and structure the management of the sustainable development function within the Group, this new body now brings together the sustainable development directors of the métiers, sustainable development functions and subsidiaries within the House. This Committee addresses the management of the entity’s roadmaps and promotes discussion on cross-functional training and internal communication issues.

Reporting to a member of the Executive Committee, this proposes and implements the Group’s strategy and oversees the approach taken by the committees and all functional and operating departments and Group subsidiaries, both in France and internationally. It monitors achievements, coordinates the operation of various committees, provides support to local committees and manages, with its internal partners, cross-functional projects and non-financial reporting.

Composed of more than 100 members representing the main métiers and central functions, as well as the French-speaking distribution subsidiaries, it analyses the technical and functional aspects of the projects carried out by the various entities of the House and enables its members to share best practices and topical sustainable development information.

Led by the main métiers and subsidiaries, they initiate and monitor the actions undertaken. These bodies may be supplemented by management and ad hoc committees when new sustainable development projects are implemented by subsidiaries and entities. Cross-functional committees, led by Group departments, manage issues, often of a medium-term nature, that are of common interest. They focus in particular on issues relating to recycling, materials innovation, the circular economy, sustainable construction and logistics.

These are responsible for leading the approach at their level and for committing to a CSR roadmap each year. The Group’s main métiers and subsidiaries have a part-time or dedicated sustainable development manager.

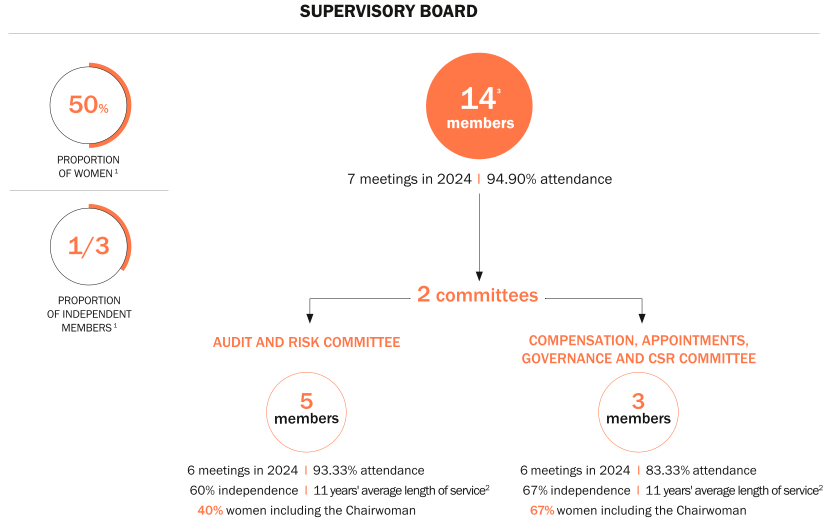

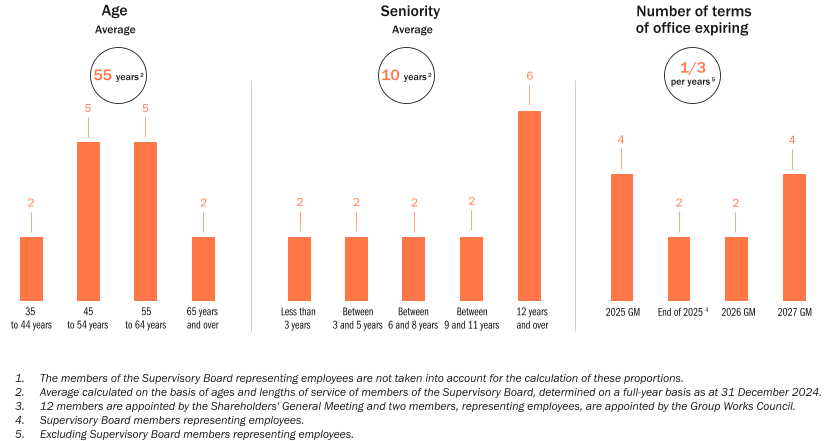

At Supervisory Board level

The Group’s Supervisory Board is involved, through its committees (see chapter 3 "Corporate governance", § 3.4), in the oversight of the proper management of the impacts, risks and opportunities (IRO) identified. It is kept informed of the process of identifying these IROs, notably through its committees and the Executive Management. Starting in 2023, a multi-year training programme on environmental issues, and climate in particular, was developed in collaboration with an external firm to raise the Board’s awareness of these issues and their reporting using the CSRD. In November 2024, the work in progress on the double materiality matrix was presented to the Board. In early 2025, the Audit and Risk Committee and the CAG-CSR Committee were given a presentation on the double materiality analysis completed during the financial year and its material IROs. This report was also presented to the Audit Committee on 13 March 2025, which also reported on it to the Board as a whole.

The Supervisory Board, in accordance with the powers granted to it (see chapter 3 "Corporate governance", § 3.5), through its two committees, is also responsible for overseeing the processes, controls and procedures in place to manage the IROs identified. This role involves regular presentations by the House’s experts on the House’s major sustainable development issues (i.e. Group sustainable development department, finance department, human resources department, compliance department, industrial department, etc.). These presentations make it possible to verify in particular the definition and achievement of the targets for the various material IROs.

The majority of Supervisory Committee members (excluding employee representative members) have skills in one or more areas of sustainability. These skills enable adequate supervision of the management of information and data relating to material impacts, risks and opportunities, within the framework of the role strictly allocated to the Supervisory Board. In addition to the aforementioned training programme, Supervisory Board members also benefited from awareness-raising conferences on environmental issues led by WWF France (World Wildlife Fund). Details of the training received by members of the Supervisory Board as well as attendance statistics are available in chapter 3 "Corporate governance", § 3.5.

Cross-reference table between the skills of Supervisory Board members (§ 3.4.5.2)

and the major issues covered by the IROs (table in § 2.1.1.6.3)2.1.1.2.3The role of the administrative, management and supervisory bodies in the conduct of business (G1 related to ESRS 2 GOV-1)

At Executive Management level, assisted by its Executive Committee

Alongside other members of the Executive Committee, the Executive Management drives compliance with ethics rules, applying a firm policy of zero tolerance of any breach of internal policies relating to compliance. Thus, the governing bodies’ commitment in terms of business conduct can be seen at the Group’s highest level. In addition, the Executive Vice-President Corporate Development and Social Affairs receives regular reports on the work of the Compliance and Vigilance Committee from the Legal Compliance Director and the Group General Counsel. In this way, these subjects are supervised directly by the Executive Committee, which supports the Executive Management.

At Supervisory Board level

The Hermès Supervisory Board monitors in particular matters relating to business conduct covered by the 2.1.4. standard. This covers in particular the fight against corruption, ethical and balanced relations with suppliers, the duty of care and animal welfare. The Supervisory Board’s expertise on business conduct matters is also presented in chapter 3 “Corporate governance”, § 3.4. Thus:

- ◆the Supervisory Board is regularly informed of the ethics and compliance programmes as well as the progress of the Group’s corruption prevention plan, in accordance with the Sapin II law, notably through its Audit and Risk Committee;

- ◆since 11 September 2018, the Supervisory Board’s rules of procedure include missions relating to the system for preventing and detecting corruption and influence-peddling;

- ◆in 2024, Hermès published its second stand-alone vigilance plan(1) and continues its continuous improvement approach to the Group’s vigilance, including: a strengthened risk mapping methodology, an in-depth risk assessment, the continued rollout of risk mitigation measures and the development of the whistleblowing system. In this respect, a presentation was made to the Audit and Risk Committee on the measures put in place to strengthen all the key processes implemented in the Group, in particular those relating to the assessment of third parties and the H-Alert! whistleblowing system.

2.1.1.2.4Information provided to and sustainability matters addressed by the undertaking’s administrative, management and supervisory bodies

2024 marks the first year of identification of IROs as required by the CSRD Directive. These IROs cover issues that have long been known and taken into account by the Group and its governance bodies. For the past two years, the Group has been analysing its material issues according to a principle of double materiality, without applying all the expectations of what would become the CSRD, but rather by already applying this multi-criteria approach to analyse the importance of the issues.

In early 2025, the double materiality matrix, as well as the main material IROs identified, were the subject of dedicated presentations to the Audit Committee and the CAG-CSR Committee, which reported on this work to the Supervisory Board. The Executive Management is involved in more operational oversight of the policies and actions associated with the main material IROs, as well as the monitoring of Group targets, included in the double materiality analysis.

At Executive Management level

- ◆the Group’s decarbonisation and carbon offset strategy (which corresponds to IRO 1 to 5);

- ◆the development of animal welfare partnerships (IRO 22 and 23);

- ◆compliance with the CSRD (cross-functional for all IROs);

- ◆the social model (IRO 24 to 29);

- ◆sustainable development training for employees and governing and governance bodies.

At Supervisory Board level

- ◆presentation of the “CSR trajectory” of the Shoes métier;

- ◆presentation of the Sustainability Academy (IRO 28 and 29);

- ◆monitoring of the use of sustainable development commitment handbooks in the métiers;

- ◆group disability policy (IRO 27);

- ◆presentation of non-financial risks;

- ◆corruption risk mapping (IRO 38);

- ◆vigilance plan (IRO 30 to 35, IRO 38);

- ◆monitoring the rollout of non-financial reporting;

- ◆update on the main achievements in 2023 and 2024 guidelines in terms of CSR;

- ◆review of the concrete actions taken as part of the social model (IRO 24 to 29).

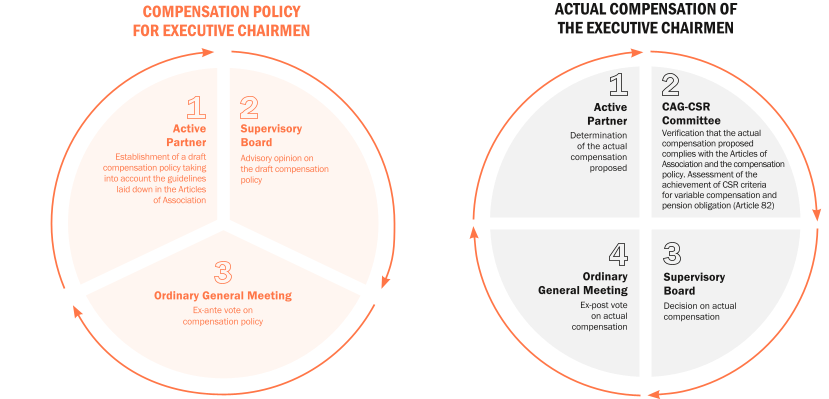

2.1.1.2.5Integration of sustainability-related performance in incentive schemes (GOV-3)

At Executive Management level

The Executive Management receives a portion of variable compensation set by the Articles of Association (known as “statutory compensation") which is subject in part (10%) to a non-financial criterion consisting of three quantifiable indices measured each year:

- ◆decoupling of activity growth at constant scope and exchange rates and the evolution of industrial energy consumption;

- ◆Group initiatives in favour of gender equality;

- ◆actions taken to promote the Group’s local presence in France and around the world, outside of major cities.

Details relating to the implementation of this criterion and the achievement of this objective are given in chapter 3, “Corporate governance”, § 3.8

At Supervisory Board level

Given the role assigned to the Supervisory Board and the compensation policy for Board members, as described in chapter 3, “Corporate governance”, § 3.8, this compensation is not subject to performance criteria. It includes a fixed component and a variable component, based on the attendance of Board members. As a reminder, the employee representative members of the Supervisory Board do not receive any compensation for their duties.

2.1.1.2.6Integration of climate sustainability performance in incentive mechanisms (E1 related to ESRS 2 GOV-3)

To date, the compensation of Hermès’ Executive Corporate Officers does not include any incentive criterion directly related to climate change mitigation or adaptation. Nevertheless, a corollary criterion determines the receipt of part of their variable compensation, i.e. the decoupling of industrial energy consumption and growth in activity.

2.1.1.3Statement on due diligence (GOV-4)

Core elements of due diligence

Paragraphs in the sustainability statement

a) Embedding due diligence in governance, strategy and business model

2.1.1.5.1

b) Engaging with affected stakeholders in all key steps of the due diligence

2.1.1.5.3

c) Identifying and assessing adverse impacts

2.1.1.6.3

d) Taking actions to address those adverse impacts

2.1.1.6.3 (Policies and actions column)

e) Tracking the effectiveness of these efforts and communicating

2.1.1.6.3 (Targets column)

2.1.1.4Risk management and internal controls over sustainability reporting (GOV-5)

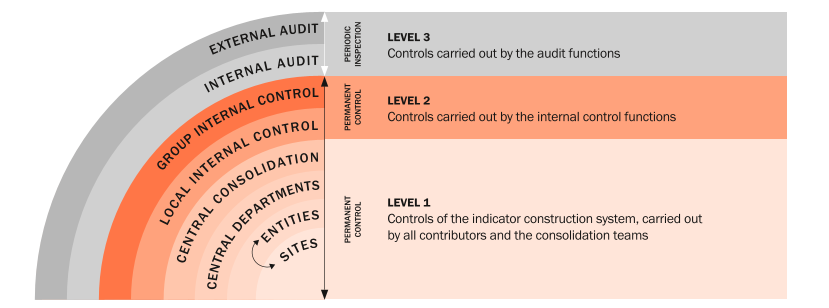

The Group’s internal control is organised into a network of correspondents, coordinated by a central unit. It operates under the authority of the audit and risk management department, which ensures the rollout of an internal control system adapted to the Group’s issues and risks across all processes (see chapter 4 “Risk factors and management”, § 4.3.).

- ◆participation in the project rollout with the departments in charge of the project (finance and sustainable development);

- ◆coordination of the work of internal controllers.

The purpose of the internal control system is to ensure the reliability of the published data (completeness and accuracy). The risk assessment method was thus as follows: work in 2024 focused primarily on quantitative metrics, in particular those resulting from manual processes including complex restatements. Certain criteria were prioritised: stakeholder expectations with regard to the Group’s activity, subject to any findings and recommendations from previous external audits or which changed significantly compared to the previous year.

For priority metrics, the central internal control unit ensured the clarity and precision of the associated reporting protocols in order to ensure homogeneity of the data reported by all contributors (precision of definitions, scope, calculation methods, etc.). Expected key controls were also added to these to ensure the reliability of the data, from their collection to their publication in the final report, including calculation, consolidation, restatement and correction if necessary.

The purpose of the controls planned and described in the reporting protocols in 2024 was to build on those already carried out in previous years as part of the NFPS (Non-Financial Performance Statement). Requirements for formalisation and documentation are nevertheless expected to increase. In some cases, additional controls have been added to this existing system, such as the verification of calculation formulas in the case of the use of manual files to collect and reprocess data. As part of a continuous improvement approach, this new requirement has led to the strengthening of the internal control culture among contributors. This involved explaining the objectives of the system, the roles and responsibilities of each function, as well as the expectations.

Since central internal control is based on level 1 controls carried out at sites and entities, it mainly carried out some checks with the help of local internal controllers on priority metrics at risk in the entities that contribute most. The local internal control network will be more heavily involved in level 2 controls from the second year of application of the CSRD.

Central internal control ensured that the controls at the level of consolidation of the central departments were carried out and documented to the expected level of requirement.

As some metrics are provided via reporting tools, the control system relied on automatic controls wherever possible, improving the formalisation of the controls carried out by the various contributors (e.g. explanation of significant changes).

To facilitate the appropriation of sustainability matters, the conclusions of the reviews carried out and the progress of the project in terms of internal control were presented at CSRD project steering committees. These committees include three members of the Executive Committee, namely the Executive Vice-President Finance, the Director of Human Resources and the Executive Vice-President of Governance and Organisational Development.

In addition, the double materiality analysis implemented as part of the CSRD was presented to the Audit and Risk and CAG-CSR Committees at a joint meeting in early 2025. The internal control system now includes an item on sustainability matters.

2.1.1.5Sustainability strategy

2.1.1.5.1Strategy, business model and value chain (SBM-1)

Details regarding the major groups of products and services offered by the Group, including its major geographic markets over the reference period, are provided in chapter 1 “Presentation of the Group and its results”, § 1.5.

The breakdown of the Group’s headcount is described in chapter 1 “Presentation of the Group and its results” § 1.4, and § 2.3.1.2.

The Group has no activity in the sectors listed by ESRS 2 in point 40b (fossil fuels, production of chemicals, weapons, cultivation and production of tobacco).

Strategy and business model

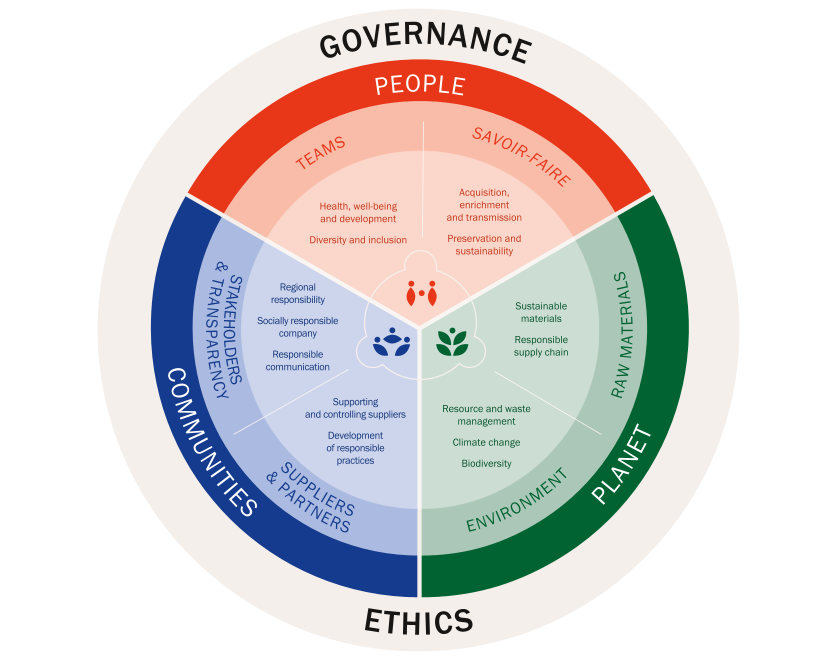

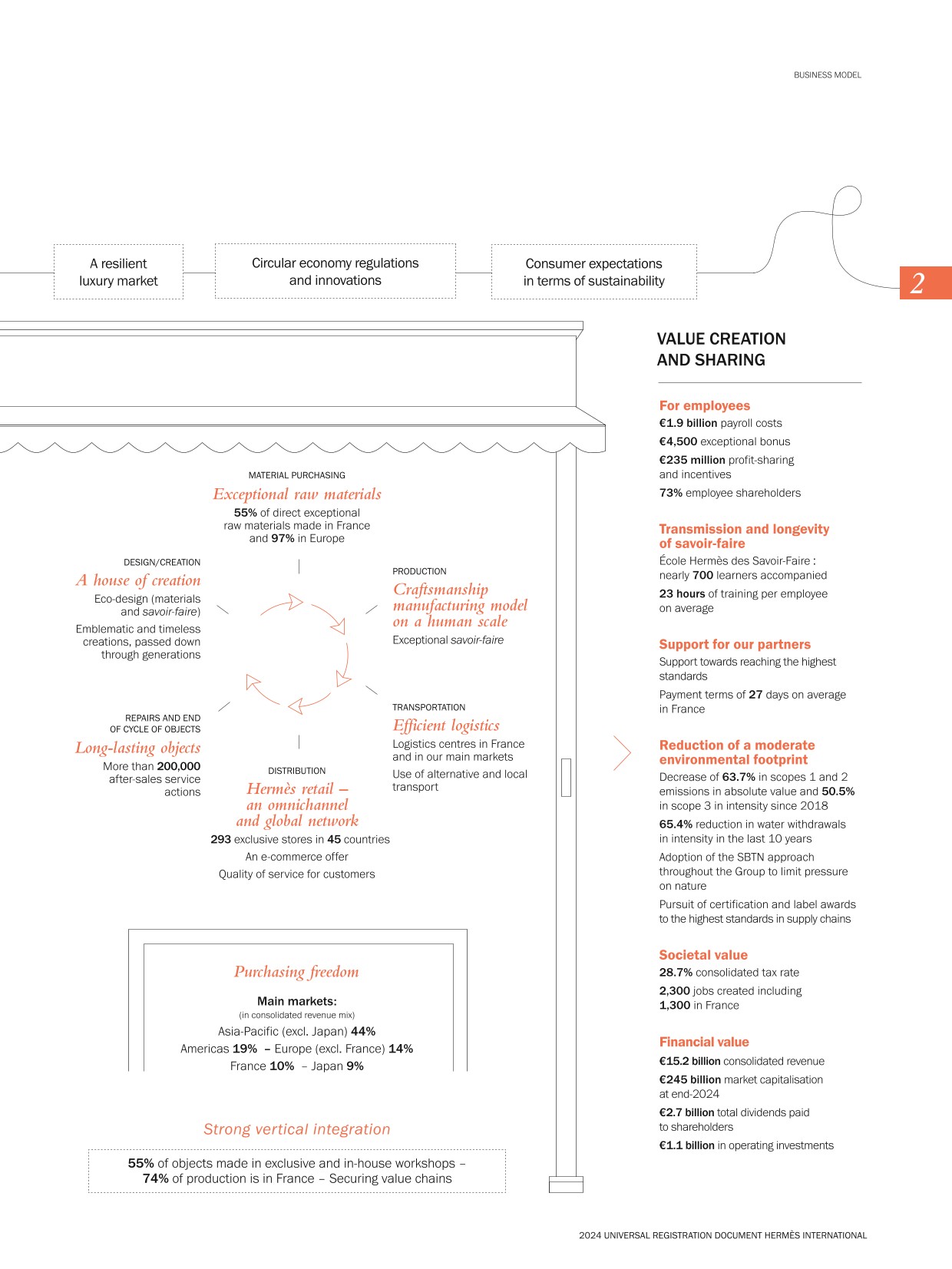

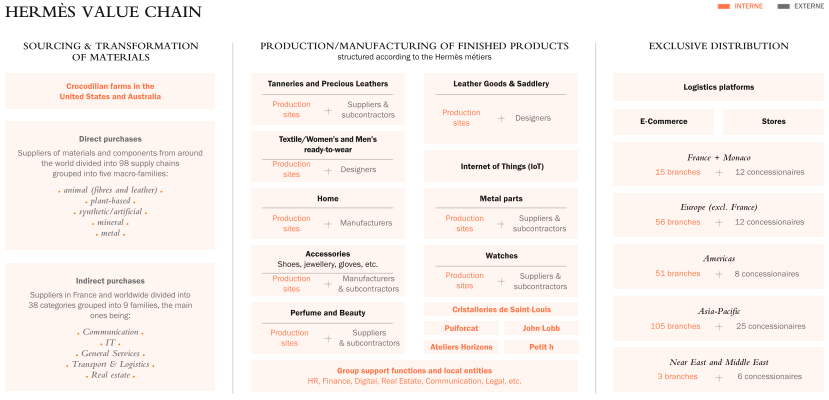

Since 1837, Hermès has been producing exceptional objects designed to last and be passed on. Moreover, with its craftsmanship savoir-faire, its exclusive distribution network and its creative heritage, Hermès integrates sustainability into all aspects of its business model, taking into account its product and service offering, its customers, geographical areas and relations with stakeholders.

Products and services

Hermès ensures that all its products are responsibly manufactured, using sustainable materials, with a frugal use of materials, an approach based on craftsmanship and by applying the principles of the circular economy in its production approach as much as possible. The Company is also working to reduce the carbon footprint of its activities, contributing to the transformation of its supply chain practices and favouring less emitting practices in its direct operations (i.e. energy efficiency, adoption of renewable energy, optimisation of logistics transport chains, etc.).

Customers

The Company strives to meet the growing expectations of its customers in terms of transparency on ethics and the environment. Since 2022, it has been gradually providing them with information on the environmental footprint of its products.

Geographical areas

Present in 45 countries, Hermès’ commitment to sustainability is global, yet adapted to local specificities. Hermès is mainly present in France (62% of its own workers, and 60 production sites). In each region where the Company operates, it works with local partners to promote sustainable practices, support a community presence and comply with local environmental regulations.

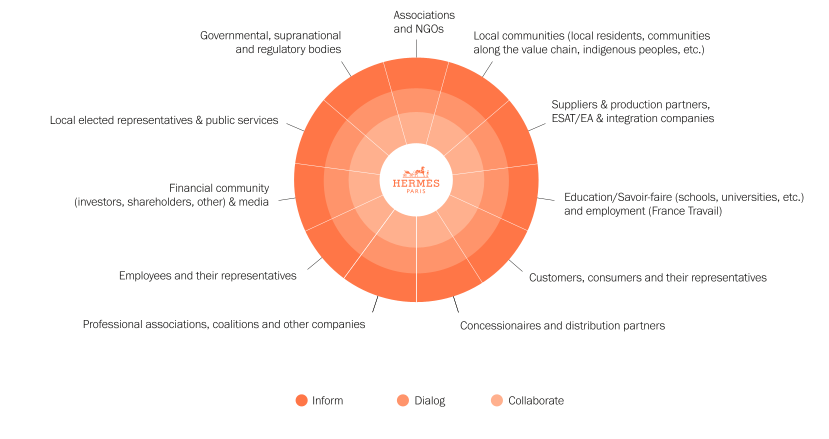

Stakeholder relations

Hermès maintains close relationships with its internal and external stakeholders to achieve its sustainability objectives, objectives that are based on a long-term approach and the building of trust. The procedures for dialogue with Group employees are described in § 2.1.3.2. For external stakeholders, dialogue is fuelled by long-term relationships of trust. An example of this is the average length of relationships between Hermès and its top 50 direct purchasing suppliers, which is 19(2) years. The Company undertakes not only to engage in regular dialogue with its suppliers, customers, employees and local communities, but also to contribute, at its own level, to the adoption of more responsible practices (e.g. raising awareness among its customers, supporting and transforming its suppliers’ practices, etc.).

Hermès regularly assesses its products and services to ensure that they are consistent with its sustainability objectives. Sustainability, the quality of the raw materials used and the quality of the savoir-faire are intrinsic characteristics of Hermès’ products. This assessment includes, for example:

- ◆an analysis of the environmental impact of the raw materials used (for example: leather, cashmere, silk, cotton, precious metals);

- ◆management of the environmental footprint throughout the product life cycle;

- ◆the implementation of eco-circular manufacturing practices whenever possible (including reuse and recycling);

- ◆limitation of unnecessary single-use plastics (particularly in product packaging and for packing items).

- ◆a range of products that can be based on a circular approach (for example, petit h, upcycled leather goods or ready-to-wear items, packaging for perfume and beauty products);

- ◆an after-sales service and repair service at each point of sale, and monitoring of the number of repair operations in various markets;

- ◆raising customer awareness of sustainable consumption practices by training sales associates in sustainable development issues.

House strategy and sustainability matters

Backed by a history shaped by six generations, Hermès evolves with the times while always respecting tradition, transmission and innovation. Thus, true to its values of freedom, demanding savoir-faire and authenticity, the House of Hermès business model includes several strategic pillars focused on sustainability issues:

- ◆women and men committed to a “family spirit”: craftsmanship values and high standards drive employees at Hermès, which undertakes ambitious social programmes to guarantee the sustainability and transmission of the savoir-faire essential to the creation of its objects;