URD 2022

-

MESSAGE FROM THE EXECUTIVE MANAGEMENT

In 2022, our house met with unprecedented success. All over the world, our customers both loyal and new showed their appreciation for our collections.

In these uncertain times, they were no doubt seeking colour, fantasy and spirit. They no doubt felt the urge to surround themselves with beautiful materials, objects made with exceptional know-how, and new creations. In the complex economic, health and geopolitical context of 2022, Hermès was more than ever synonymous with confidence.

These results support our business model: Hermès is a house of creation offering objects for every day that are both durable and functional, objects of assertive style and uncompromising quality. Commended for its responsible approach, which places people at its heart, Hermès remains in tune with the times. We are pleased to have been able to continue to invest in our production capacities, creating jobs, mainly in France, to have maintained our work in training and passing on artisanal skills, and in the research and development of fine materials, and to have continued to support our long-standing partners.

Hermès is upholding and renewing its environmental and social commitments in order to maintain a virtuous circle of growth, for both its employees and its partners, and more broadly for all of its communities and ecosystems.

In 2022, the House launched Hermès Plein Air, its complexion line, and received two major watchmaking awards for Arceau, Le temps voyageur. We will also never forget the opening of the new Maison Hermès at 706 Madison Avenue in New York and the Kelly en désordre bag! But 2022 will also and above all remain the year of our first cohort of trainees at the École Hermès des savoir-faire, which awards the French certificate of professional aptitude in leatherworking; the year the Company was named in the list of SBF 120 companies feminising their governing bodies; and the year in which Hermès employed nearly 20,000 people.

-

HIGHLIGHTS 2022

The group’s consolidated revenue amounted to €11,602 million in 2022, up 29% at current exchange rates and 23% at constant exchange rates compared to 2021. Recurring operating income amounted to €4,697 million, i.e. 40.5% of sales. Net profit (group share) reached €3,367 million, representing net profitability of 29%.

In the fourth quarter 2022, the great sales momentum recorded at the end of September continued, with sales reaching €2,991 million, an increase of 26% at current exchanges rates and 23% at constant exchange rates.

Axel Dumas, Executive Chairman of Hermès, said: “In 2022, Hermès had an exceptional year thanks notably to the good performance of its international markets. This success reinforces our approach as an artisanal and highly integrated company, mainly in France: a design house that offers objects conceived to be functional, with an assertive style and uncompromising quality. The year underpins the relevance of our responsible and sustainable model.”

Over the last three years, Hermès created 4,300 jobs, including 2,900 in France, and reinforced its operating investments by €1.5 billion, including c. 60% in France.

Sales by geographical area at the end of December

At the end of December, sales growth was remarkable across geographical areas. Sales increased considerably both in group stores (+23% at constant exchange rates) and in wholesale activities (+26%), which benefited from the recovery in travel retail. Hermès continued to develop its exclusive distribution network, while online sales pursued their upward trend worldwide.

Asia excluding Japan (+22%) remained very dynamic throughout the geographical area. Sales performance in Greater China was sustained. In October, a fourth store opened in the Qiantan district in Shanghai, Mainland China, and Hermès inaugurated a store in Pangyo, in South Korea. Several stores reopened after renovation and extension work, such as the Hyundai Coex store in Seoul in December and the Hong Kong international airport store in November.

Japan (+20%) recorded a steady, sustained increase in sales. In November, the Takashimaya store in Nagoya reopened after renovation and extension in a new location, and the Hermès in the Making exhibition showcased the house’s know-how in Kyoto.

The Americas (+32%) saw an exceptional year in 2022. After the April opening of a new store in Austin, a new maison was inaugurated at 706 Madison Avenue in New York in September. This store offers clients an unprecedented experience of the creativity of Hermès and confirms the house’s attachment to the sustainability of objects with a whole floor dedicated to repairs. In Mexico, the store in Guadalajara reopened in October after renovation.

-

1. Presentation of the group and its results

-

1.1Six generations of craftspeople

The Hermès adventure began in 1837 when the harness-maker Thierry Hermès opened a workshop in rue Basse-du-Rempart in Paris. Gradually, generation after generation, the House followed a dual thread – on the one hand the painstaking work of the craftspeople in his workshop, and on the other the active lifestyles of its customers. Carried by an enduring spirit of freedom and creativity, Hermès remains highly sensitive and attentive to the changing nature and needs of society.

In 1880, Charles-Émile Hermès, the founder’s son, moved the workshops to 24, rue du Faubourg Saint-Honoré, and set up an adjoining store. At this now-emblematic address, harnesses and saddles were made to measure. The business was already standing out for the excellence of its creations.

AN INNOVATIVE HOUSE PASSIONATE ABOUT ITS ERA

During the interwar period, lifestyles changed and the House broke new ground under the management of Thierry’s grandson, Émile Hermès. He decisively influenced the family firm’s destiny when, while travelling in Canada, he discovered the opening and closing system of an automobile hood. In 1922 he obtained exclusive rights to this American “universal fastener” – known today as the zip – which was used extensively in the House’s luggage and other designs. Under the impetus of Émile Hermès, the House opened up to other métiers, while retaining a close connection with the equestrian world, drawing on its mastery of raw materials and its artisanal culture to create its first ready-to-wear collections. In 1937, the famous silk scarf was born with the Jeu des omnibus et dames blanches design, the first in a long series.

Robert Dumas – one of Émile Hermès’ sons-in-law, who took the helm of the House in 1951 – was a regular visitor to the workshops and designed objects whose details (buckles, fasteners, saddle nails and anchor chains) exuded an elegance that in no way diminished their practicality. Hermès objects stand out for their noble materials, their mastery of savoir-faire, and their bold creativity, stimulated by the House’s keen vision of the world. The Silk métier now invites artists to create unique designs.

-

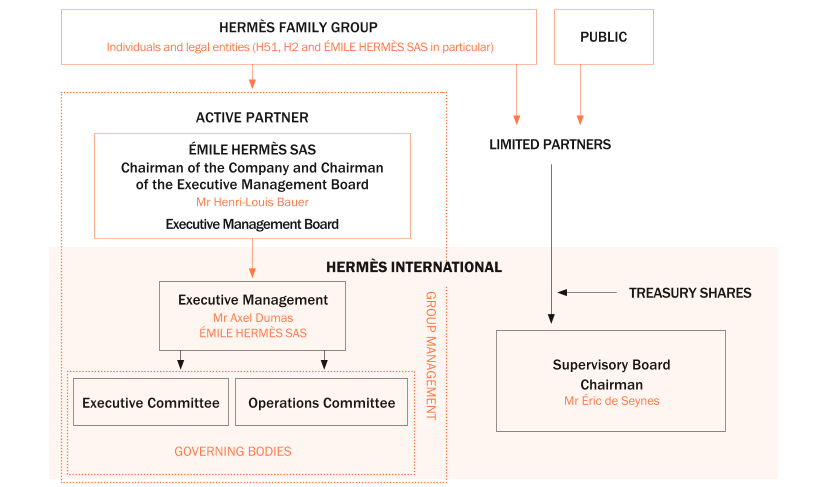

1.2Group governance

The Executive Management ensures the management of Hermès International. The role of Executive Chairman is to manage the Group and act in its general interest, within the scope of the corporate purpose and subject to those powers expressly granted by law or by the Articles of Association to the Supervisory Board, to the Active Partner and to Shareholders’ General Meetings.

The Executive Chairmen’s roles are distributed as follows: Axel Dumas is in charge of strategy and operational management, and Émile Hermès SAS, through its Executive Management Board, is responsible for vision and strategic priority areas.

The Executive Chairmen are supported in their management of the Group by the Executive Committee. This consists of Executive Vice-Presidents, each of whom has well-defined areas of responsibility. The role of the Executive Committee is to oversee the Group’s strategic and operational management. Its composition reflects the Group’s main areas of expertise.

The Operations Committee, which reports to the Executive Management, is made up of the Executive Committee and the Senior Executives of the main métiers and geographical areas of the Group.

- •to involve Senior Executives in the Group’s major issues and strategic orientations;

- •to promote communication, sharing and reasonable exchanges amongst its members in their area of responsibility;

- •to enable the Executive Committee to take certain decisions.

-

1.3 Strategy

Hermès is an independent company backed by family shareholders. Its strategy is based on three pillars: creation, craftsmanship and an exclusive distribution network.

Since 1837, the Group has remained true to its values of freedom, demanding craftsmanship savoir-faire, authenticity and responsible growth. Its integrated craftsmanship business model places quality and sustainability at the centre.

Creation at the core of Hermès’ strategy

Hermès creates and manufactures quality objects designed to last, to be passed on from one generation to the next, and to be repaired. This approach requires these issues to be taken into account at every stage, from design to sales.

Hermès’ strategy is based on creative freedom. Each year, a theme inspires creators and Artistic Directors. Driven by a history spanning nearly 200 years, during which the House has continued to develop with audacity and ingenuity, Hermès paid homage to the theme of lightness in 2022. Never lacking depth, it is a source of creative vitality and nurtures Hermès’ positive and resilient mindset.

High standards in design and manufacturing encourage the creation of objects that aim to surprise and amaze customers. This creativity, revolving around traditional savoir-faire, is coupled with innovative processes to revisit timeless models and create exceptional pieces, without departing from Hermès’ trademark humour and imaginative flair. The unbridled creativity flourishes in each métier, as reflected in the numerous scarf designs printed every year. It is then expressed through over 50,000 references, developed around a unique identity and a style blending exceptional quality, innovation, surprise, elegance and simplicity. In 2022, it was expressed in particular with the fourth chapter of the Beauty story, Hermès Plein Air, the new Haute Bijouterie collection, Les Jeux de l’ombre, and the Home universe, with the new Soleil d’Hermès tableware.

-

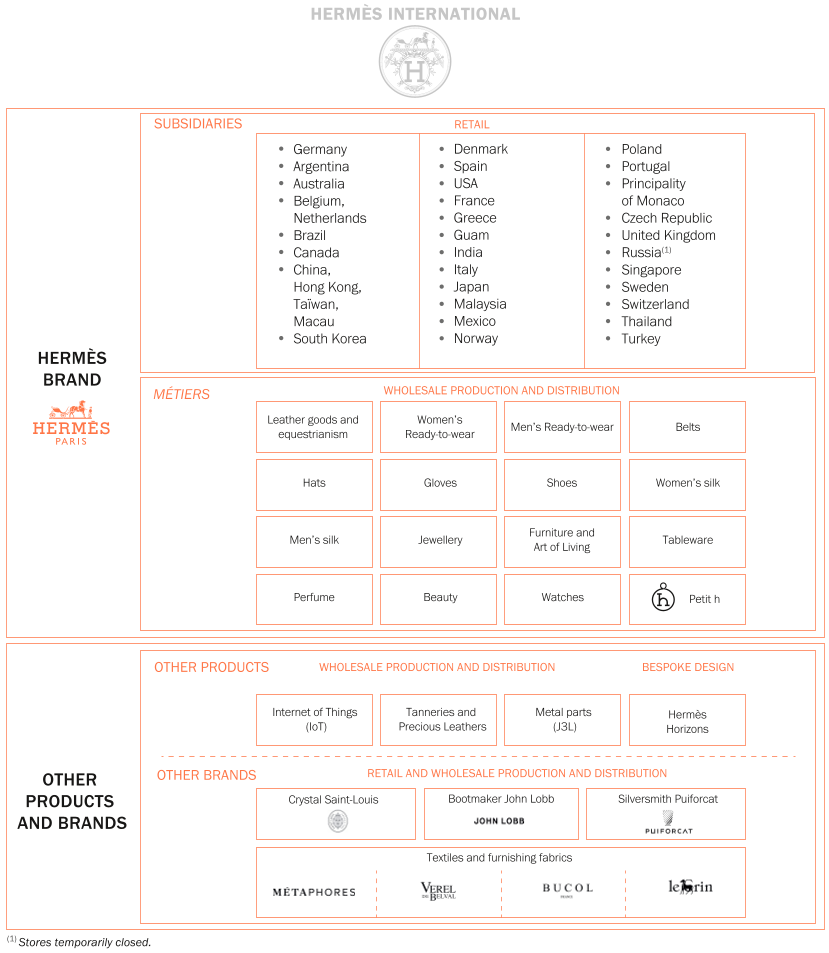

1.4Simplified organisation chart and group locations

The main consolidated companies as at 31 December 2022 (distribution subsidiaries and holding companies of the divisions) are listed in note 16 of the consolidated financial statements.

1.4.2Integrated production and training sites worldwide

Métiers

Country/French region

Number of sites

French locality

Leather Goods & Saddlery

France/Auvergne-Rhône-Alpes

8

Aix-les-Bains

Belley

Bons-en-Chablais

Fitilieu (EHSF)*

Les Abrets

Pierre-Bénite

Riom (Training workshop)

Sayat

France/Bourgogne-Franche-Comté

3

Allenjoie

Héricourt

Seloncourt

France/Grand Est

3

Bogny-sur-Meuse

Charleville-Mezières (EHSF)*

Tournes-Cliron (2023)

France/Île-de-France

5

Montereau

Pantin CIA

Pantin Pyramide

Paris Faubourg Saint-Honoré

Paris Saint-Antoine

France/Normandy

3

Louviers (2023)

Louviers (EHSF)*

Val-de-Reuil

France/Nouvelle-Aquitaine

5

Montbron

Montbron (EHSF)*

Saint-Vincent-de-Paul

Nontron

Saint-Junien

Tanneries and Precious Leathers

France/Auvergne-Rhône-Alpes

2

Annonay

Le-Puy-en-Velay

France/Centre-Val de Loire

1

Chabris

France/Île-de-France

1

Montereau

France/Pays de la Loire

1

Vivoin

Australia

6

United States

2

Italy

1

Perfume and Beauty

France/Normandy

1

Le Vaudreuil

Textiles

France/Auvergne-Rhône-Alpes

9

Bourgoin-Jallieu – 4 sites

Bussières

Irigny

Le Grand-Lemps

Pierre-Bénite – 2 sites

France/Nouvelle-Aquitaine

1

Nontron

France/Pays de la Loire

1

Challes

Crystal Saint-Louis

France/Grand Est

1

Saint-Louis-lès-Bitche

Silversmith Puiforcat

France/Île-de-France

1

Pantin-CIA

Tableware

France/Nouvelle-Aquitaine

2

Nontron

Saint-Just-le-Martel

Watches

Switzerland

2

Metal parts (J3L)

France/Bourgogne-Franche-Comté

2

Bonnétage

Châtillon-le-Duc

France/Hauts-de-France

1

Roye

France/Île-de-France

2

Champigny-sur-Marne

Portugal

1

Bootmaker John Lobb

France/Île-de-France

1

Paris Mogador

United Kingdom

1

Shoes

Italy

1

* EHSF: École Hermès des savoir-faire

-

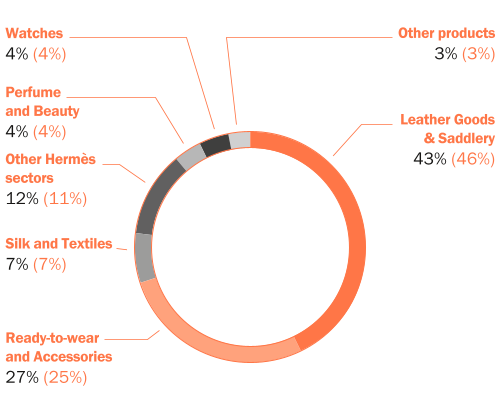

1.6Revenue and activity by métier AFR

In millions of euros

2022

Revenue2022

Mix2021

Revenue

2021

Mix

Change

at current exchange rates

at constant exchange rates

Leather Goods & Saddlery

4,963

43%

4,091

46%

21%

16%

Ready-to-wear and Accessories

3,152

27%

2,219

25%

42%

36%

Silk and Textiles

842

7%

669

7%

26%

20%

Other Hermès sectors

1,371

12%

1,001

11%

37%

30%

Perfume and Beauty

448

4%

385

4%

16%

15%

Watches

519

4%

337

4%

54%

46%

Other products

306

3%

279

3%

10%

8%

Consolidated revenue

11,602

100%

8,982

100%

29%

23%

1.6.1Leather Goods & Saddlery

Leather Goods & Saddlery, Hermès’ original métier, encompasses bags for men and women, travel articles, small leather goods and accessories, saddles, bridles, and a full range of equestrian products and clothing.

The Leather Goods & Saddlery métier represents 43% of consolidated sales. In 2022, it generated revenue of €4 963 million.

Hermès saddlery and leather goods are the result of a very special alchemy. It is based on a constant dialogue between designers and craftspeople, and the use of the finest materials, selected with great care. The craftspeople use traditional savoir-faire, passed down from generation to generation. The care taken by the craftspeople each day patiently crafting and fashioning the leather gives these unique objects a distinctive additional measure of personality.

They are made by more than 4,700 saddler-leather craftspeople, spread across nine centres of expertise that bring together production units, workshops and training centres in Paris, Pantin and six regions of France. To meet continued strong demand, Hermès is expanding its network of manufacturing sites each year in order to strengthen its production divisions. Five new site projects are thus underway for the next five years. Following the inauguration in 2021 of two leather goods workshops, in Gironde and Seine-et-Marne, the Alpes division was strengthened in 2022 with the integration of the Thierry leather goods workshop (Haute-Savoie), a long-standing partner. Two new leather goods workshops are under construction, one in the Eure region, which is scheduled to open in April 2023, and the other in the Ardennes, which will come on stream in May 2023. A new building is also being built at the Saint-Junien glove and leather goods workshop (Haute-Vienne), with a view to doubling its workforce from June 2023. Lastly, work on the new production unit in Riom (Puy-de-Dôme) began in September 2022, and is scheduled to open in 2024. Hermès is also preparing the start of work on two future production units planned for 2025 in L'Isle-d'Espagnac (Charente) and 2026 in Loupes (Gironde). All these establishments are set up in close collaboration with the various local stakeholders and regional administrative and economic development bodies. In this way, Hermès reaffirms its commitment to regions with a strong manufacturing savoir-faire and its will to provide high-quality jobs.

The House is also continuing to perfect the skills and savoir-faire of its craftspeople through a range of training and professional qualification programmes. These programmes are delivered within the École Hermès des savoir-faire and through a range of partnerships with training structures in the regions concerned.

1.6.1.1 Women's bags

Once again this year, women’s bags unfurl with a focus on the latest habits, to create resolutely modern companions. Like the Hermès Geta bag, which can be worn over the shoulder, a supple model with a “sport-chic” satchel spirit and a compact format, designed around a clever clasp. The unlined In the Loop bucket bags, beautifully signed with the Chaîne d’ancre link, enrich the family of everyday companions with two formats in just the right proportions. As for the Boucle Sellier bag, this brand new item, with its assertive “rock” feel, is adorned with a chiselled metal part borrowed from the jewellery range.

This year celebrates the return of the Constance 24 bag in a pure and refined version. With its single gusset, harking back to the origins of the model, this slim format is embellished with a pocket on the back and an interior mirror.

The evening universe is enriched with dedicated creations and its refined signature is inscribed on the clasps and materials. Thus, the new Cadenas clutch bag, which introduces a novel hands-free way to carry it, highlights the savoir-faire of its leather casing.

The reinterpretation of the great classics is expressed through exceptional versions, designed in an Arts & Crafts spirit: daring and surprising stories that constantly push the boundaries of creation and savoir-faire. With its double-sided construction and its interplay of perspectives where asymmetry creates a new balance, the “En désordre” story shakes up the traditional references on the Kelly II Sellier 20, the Birkin 30 and the Bolide 1923-25. The Kellydole bag, with its anthropomorphic allure, is back with a pixelated spirit, enhanced with a shoulder strap and a satchel that can hold a phone. The ultimate piece, and a triumph of the skill of the silversmith, the Kelly Midas bag emerges from the unprecedented fusion between metal and leather, with the matching of Box calfskin and a solid 18-carat gold handle. In a playful spirit, the “Colormatic” animation is a play on contrasting colours and gives the bags an additional functionality with a new zipped front pocket as well as a back pocket.

Natural materials are also enriched with, for example, the highlighting of the mane on the Toupet bag, a small bucket bag full of imagination.

1.6.1.2 MEN'S BAGS

The men’s collections have multiplied the offering in response to contemporary uses and revisit the identity codes of the great classics. A new timeless model available in two formats, the HAC à dos is designed for mobility with its hands-free carrying mode. It sports the iconic details of the Haut à courroies, the House’s very first bag. The emblematic Sac à Dépêches continues to reinvent itself in a new, smaller, compact size to carry the essentials close to hand. The Hermès Allback model, the first men's backpack in canvas and leather, boasts an adventurous spirit thanks to its Toile Bivouac, a new resistant and light technical material, and its multiple functional features.

Lastly, the Arts & Crafts odyssey continues with the major essentials of the men's universe: the Haut à Courroies bag dresses with a perfecto for a “rock” attitude in an exceptional version with singular details.

1.6.1.3 TRAVEL

Introduced at the end of 2021 in France and China, the R.M.S. case is continuing its rollout and is expanding its presence to more than 15 stores worldwide. Resolutely innovative and customisable through the play of handles and wheels, it offers a wide variety of materials and colours. The printed versions make it even more unique, like the very latest drawing, the mischievous Traffic Jam.

1.6.1.4 Accessories and small leather goods

A land of experimentation, the small leather goods collections are enriched each season to offer a multiplicity of uses in a joyful and colourful spirit, while continuing to cultivate timelessness.

With their compact format and their hands-free carrying mode perfectly adapted to today’s uses, objects such as the Constance Slim and the Roulis Slim confirm their success, alongside the small leather goods To Go.

Very much a contemporary item, the Hermèsway line is an all-in-one that carries the everyday essentials close to hand: phone, cards and lipstick. Its side case, signed with two stripes, echoes the world of Beauty.

Small leather goods for men are also enhanced with a new timeless line, H sellier. Stylish and discreetly signed with a hand-sewn H, it is available in two classic formats, essential for everyday life: a card holder and a glasses case.

Lastly, charms, those playful and colourful accessories, continue their rollout: Wink is a glasses case to take everywhere with you or hang on your bag; Ulysse Nano is a functional miniature of the emblematic diary cover, and Hermès Budy, a very soft small dog, adorns the bag of the urban rider.

1.6.1.5 MATERIALS

What better language than that of materials to tell the story of Hermès objects? Through their supple hand, their touch, their shades, their shine, their drape, leathers and woven cloths appeal to the senses, reassure, flatter, and sublime them. This dialogue enriches the collections over time, in a constant quest for excellence.

Beauty and sensuality are the key words of the collection of materials. Around the base of Heritage leathers (Box, Barénia, Vache naturelle, etc.), in the purest tradition of excellence, some 40 leathers illustrate this unique profusion of softness, sheen, relief and allure.

Textile is continuing to explore new identities with the Toile Bivouac, designed for travel and roaming, with its highly resistant ripstop weave. Exceptionally lightweight, it results from a weave that is both sensual and technical, distinguished by a small square with a gentle relief, the result of the skilful interweaving of threads. It combines the sensuality of organic cotton with the strength of recycled polyester, for a firm and supportive hand.

1.6.1.6 Equestrianism

In 2022, the Hermès saddle shone at the highest sporting level thanks to the performance of the House’s partner riders. In dressage, the German rider, Jessica von Bredow-Werndl, world number one in this discipline, won the World Cup final with a Hermès Arpège saddle in April. In show jumping, the Belgian Jérôme Guéry was crowned vice-world champion at Herning with a Hermès Cavale saddle.

It is from the collaboration between Jérôme Guéry, the Hermès' craftspeople and saddlery experts – and from this triple expertise – that the Selle Rouge was born, presented at the 12th edition of the Saut Hermès at the Grand Palais Éphémère. Depth of the seat, a slim tree fork, recessed knee rolls and a small skirt integrated into the flap: the Selle Rouge is at one with the horse and reveals, at first glance, its technical and aesthetic innovations.

In addition, the métier confirmed its commercial momentum, both in saddles and across all its universes with, for example, the launch of the Hermès Fit line, a wardrobe that accompanies riders throughout the day, or the collection of objects for dogs that continue to surprise customers and offer fun and unique experiences in stores.

-

1.7Revenue and activity by geographical area AFR

In millions of euros

2022 revenue

in €M

2022 mix

in %

2021

2021

Change

at current exchange rates

at constant exchange rates

Europe

2,600

22%

2,140

24%

21%

22%

- sFrance

1,064

9%

838

9%

27%

27%

- sEurope (excl. France)

1,536

13%

1,303

15%

18%

18%

Asia-Pacific

6,657

57%

5,227

58%

27%

22%

- sJapan

1,101

10%

977

11%

13%

20%

- sAsia-Pacific (excl. Japan)

5,556

48%

4,251

47%

31%

22%

Americas

2,138

18%

1,458

16%

47%

32%

Other

207

2%

156

2%

33%

32%

Consolidated revenue

11,602

100%

8,982

100%

29%

23%

1.7.1 Europe

In France, Hermès opened a new store in Strasbourg in November. Located on Place Broglie – formerly Place du Marché-aux-Chevaux, a name that echoes the House’s roots – this store is located in the heart of the historic city centre close to the former premises occupied since 1988. All the métiers are presented in a warm and bright 300 m2 space, with an architectural style inspired by the geometry of the circle. On the ground floor, three large glass screens designed as contemporary stained-glass windows evoke the cive, a blown glass crown, in homage to the Alsatian glassmaking tradition.

Numerous events punctuated this year at a steady rhythm. The men's ready-to-wear collection launched the year in January with the presentation of the fall-winter 2022 collection. Held at the Mobilier National in front of 200 guests, this keenly awaited return to a traditional catwalk show was broadcast live on the Internet and simultaneously screened to the Chinese and American press. At the end of January, the new Soleil d'Hermès tableware service came to illuminate the Gaîté Lyrique with its rich shades of yellow, for its unveiling to the press and buyers.

In March, a breath of fresh air heralded spring, with the launch of the fourth chapter of Hermès Beauty: Hermès Plein Air, dedicated to the complexion. Invited to discover it in the unspoiled natural setting of the Somme Bay, journalists and influencers from around the world were able to share a moment of sporty relaxation by the sea. Spring was just as dynamic in Paris with the fall-winter 2022 women’s ready-to-wear catwalk show at the Garde Républicaine, the presentation of the new collections of objects at the rue d’Anjou showroom, and the return of the Saut Hermès, whose 12th edition took place under the wooden dome of the Grand Palais Éphémère, opposite the Eiffel Tower. At the end of March, more than 150 journalists and influencers were welcomed to Paris to celebrate the annual theme at La Fabrique de la Légèreté, a poetic show featuring the legendary figure of Pegasus in tales mixing dance, the theatre of objects, music and film. In early May, the launch of Terre d’Hermès Eau Givrée caused a new thrill.

Summer, placed under the sign of light and freedom, began with the spring-summer 2023 men's ready-to-wear catwalk show in the Manufacture des Gobelins, before the new haute bijouterie collection, Les Jeux de l’ombre, unveiled its contrasting pieces in the Faubourg Saint-Honoré store in the month of July.

The final quarter saw women’s ready-to-wear take over the Paris Tennis Club during Fashion Week, to reveal its spring-summer 2023 collection. La Fabrique de la Légèreté returned to Paris at the end of October for a seven-day stopover in La Villette. Open to the public, it welcomed 6,000 visitors and reserved a session for students from design schools.

In Europe, several highlights marked the year. In February, a special evening was organised in London around the spring-summer 2022 women's ready-to-wear collection, transforming the illustrious Old Sessions House into a playful and flamboyant summer universe.

In March, Hermès took advantage of its presence at the Watches & Wonders trade show in Geneva to present its new Arceau Le temps voyageur, an ode to the exploration of space, time and imagination.

In May, the travelling exhibition Hermès in the Making stopped in Turin for ten days. It invited visitors to learn more about Hermès’ sustainable craftsmanship model through demonstrations, meetings, films, workshops and events. Also in Italy, the Milan Design Week hosted the House’s latest textile creations in June, in a light and transparent setting. In addition, Hermès took part, through its interior design subsidiary Métaphores, in the renovation of the café of the historic Circolo Filologico Milanese, one of the oldest cultural institutions in the city.

In Spain, a new store opened in Barcelona at the end of November. Located on rue Paseo de Gracia, very close to the previous address, in a late 19th century building whose façade has been restored, its 350 m2 stretch over two high-ceilinged storeys and opens onto a delightful patio planted with Mediterranean species. The walls, with their natural curves, evoke the modernist architecture of Gaudi, and the colour palette of marine tones enhanced with touches of pink and orange illustrates the communicative eccentricity of the Catalan capital. The House’s 16 métiers are on display in a warm atmosphere bathed in natural light.

-

1.8Comments on the consolidated financial statements AFR

1.8.1Income statement

In millions of euros

2022

2021

Revenue

11,602

8,982

Cost of sales

(3,389)

(2,580)

Gross margin

8,213

6,402

Sales and administrative expenses

(2,680)

(2,137)

Other income and expenses

(836)

(734)

Recurring operating income

4,697

3,530

Other non-recurring income and expenses

-

-

Operating income

4,697

3,530

Net financial income

(62)

(96)

Net income before tax

4,635

3,435

Income tax

(1,305)

(1,015)

Net income from associates

50

34

CONSOLIDATED NET INCOME

3,380

2,454

Non-controlling interests

(13)

(8)

NET INCOME ATTRIBUTABLE TO OWNERS OF THE PARENT

3,367

2,445

In 2022, the Group’s consolidated revenue amounted to €11.6 billion, up 23% at constant exchange rates and 29% at current exchange rates compared to 2021.

The gross margin rate was 71%, down slightly by 0.5 points compared to 2021. This change is due to a dilutive conversion effect, partially offset by a leverage effect on fixed production costs and by exceptional collection flow rates.

Sales and administrative expenses, which represented €2,680 million, compared with €2,137 million in 2021, notably included €525 million in communication expenses, compared with €421 million in 2021. Other sales and administrative expenses, which include mainly the salaries of sales and support staff as well as variable rents, amounted to €2,155 million compared to €1,715 million in 2021.

Other income and expenses amounted to €836 million, compared with €734 million in 2021. They include depreciation and amortisation of €552 million (€512 million in 2021), half of which relates to property, plant and equipment and intangible assets and the other half to right-of-use assets. The steady increase in depreciation and amortisation reflects continued investments in the extension and renovation of the distribution network, digital technology and information systems. Other expenses also include €65 million related to free share plans and €61 million related to the new five-year commitment to the Fondation d’entreprise Hermès (2023-2027).

Recurring operating income amounted to €4.7 billion, up by 33% compared to 2021. Thanks to the leverage effect generated by the strong growth in sales and the exceptional performance of the collections, annual recurring operating profitability reached its highest level ever at 40.5%, compared with 39.3% in 2021.

Net financial income, which includes, in particular, interest on lease liabilities, financial income from cash investments and the cost of foreign exchange hedges, represented a net expense of €62 million, compared with €96 million in 2021.

The income tax expense amounted to €1.3 billion and represents an effective tax rate of 28.2%. The decrease of 1.3 points compared to the rate published for 2021 (29.5%) is mainly due to the decrease in the corporate tax rate in France.

After taking into account the net income from associates (income of €50 million) and non-controlling interests, the consolidated net income attributable to owners of the parent amounted to €3.4 billion compared with €2.4 billion in 2021, i.e. an increase of 38%. Net profitability also reached a record level of 29.0% and gained nearly 2 points compared to 2021.

-

1.10 Outlook AFR

On the strength of its unique business model, based on its values of independence, entrepreneurial spirit, craftsmanship and creativity, Hermès has shown its solidity, with particularly robust results in 2022. Sales growth was remarkable in all geographical areas, with strong performance by the House in international markets. Leather Goods continued to grow, while all métiers grew strongly, reflecting the desirability of the creations among its customers. Hermès, firmly rooted and inspired by its heritage, is enriched by its creative freedom and innovation, and its attachment to savoir-faire. Firmly believing that there can be no creation of economic value and long-term development without creation of social and societal value and without environmental responsibility, Hermès is committed to leaving a positive footprint on the world.

Strengthened by the ongoing dialogue between creation and excellence in savoir-faire, the House will continue to blossom, affirming the uniqueness of its style. The year 2023 will be marked by the development of new collections based on the most beautiful materials and an abundant creativity. Among the new products, the Perfume and Beauty métier will launch Un Jardin à Cythère, the House’s seventh garden fragrance, as well as unveiling the fifth chapter of the Beauty story, highlighting the eyes, in the fall. Watches will continue to roll out its H08 line, flourishing since its launch in 2021, as well as its latest complication, Arceau Le temps voyageur, and will present its new products at the Watches & Wonders trade show in Geneva. As part of Milan Design Week, Hermès will unveil the new collections of the Home universe with a focus on furniture items, such as the Contour d'Hermès sofa or the Ancelle d'Hermès chair. The Saut Hermès service will be launched this year. Bags with equestrian origins, the Arçon, in Barénia Faubourg calfskin, and Petite Course, in box leather, concentrating the House’s craftsmanship savoir-faire, will enrich the leather goods collections. This year, Jewellery will highlight the emblematic Chaîne d'Ancre in an event revealing new creations using this link.

The integrated and exclusive distribution network will continue to strengthen its omnichannel offer, with particular attention on accelerating the digitisation of uses and developing services to continue to nurture ties with its particularly loyal local customers. The qualitative development of the store network will continue in 2023, with plans to open, expand or renovate stores in Chengdu and Beijing Peninsula (mainland China), Naples, Aspen and Chicago (United States), and Bordeaux (France). Priority will be given to expansions and renovations, in some 20 branches around the world. The House will continue its digital strategy, via an increasingly broad range of online products and services, with the aim of increasing traffic and attracting new customers.

In view of the House’s particularly strong momentum, the development of production capacities will continue across all métiers, and in particular in Silk, with the planned new printing line at the Pierre-Bénite textile site near Lyon, in Jewellery and in Home. The strong demand in Leather Goods & Saddlery will be supported by the ramp-up of the new sites in the nine centres of expertise spread across the country, with their manufacturing facilities, workshops and training centres. With more than 4,700 leather goods craftspeople in France today, the Group will continue its objective of opening an average of one new production unit per year, representing around 300 new employees. Hermès will inaugurate two new leather goods workshops in 2023, one in Louviers in the Eure region, and the other in Sormonne in the Ardennes. The leather goods workshop projects in Riom (Puy-de-Dôme), L'Isle-d'Espagnac (Charente) and Loupes (Gironde) will continue. Hermès will strengthen its integration in France in regions with high manufacturing savoir-faire and develop employment and training. The House’s other métiers will continue to use their extensive savoir-faire to design and create exceptional objects.

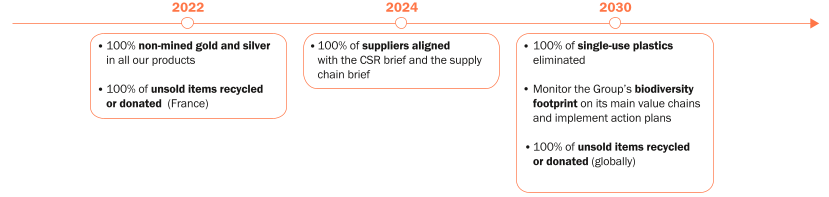

True to its commitment as a responsible employer, with the creation of 4,300 jobs over three years, of which more than 60% in France, Hermès will continue its multi-local and multi-métier job creation dynamic in 2023. The Group will step up its efforts in terms of social, societal and environmental performance. Hermès will pursue its commitment to the development of its employees, inclusion and diversity. The enhancement and transmission of savoir-faire will remain at the heart of the priorities of the métiers, with, in particular, the opening of the in-house apprentice training centre (CFA) dedicated to the leather goods métiers. Following the opening of the Ardennes division, the École Hermès des savoir-faire will be gradually introduced to all the regional Leather Goods divisions. The control of supply chains, which ensures the quality of our materials, will be strengthened by the continued implementation of “CSR briefs”, distributed to all our partners. They bring together in one place the Group’s requirements in terms of traceability, certification, carbon trajectory, reduction of water consumption and respect for human rights.

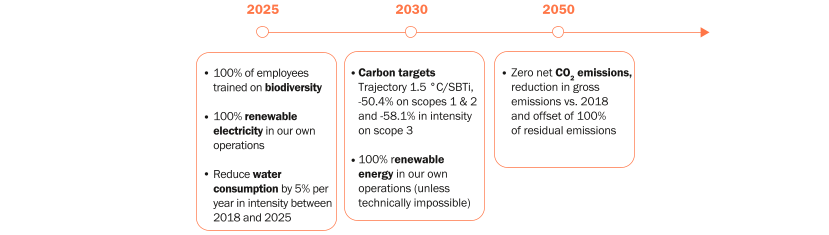

The House’s commitments to fighting climate change and the preservation of biodiversity will remain at the forefront. With the development of eco-design strategies for all métiers and the construction of an internal tool to make life cycle analyses systematic, the Group will continue its efforts to encourage the sparing use of resources and waste management. More broadly, the Group’s actions in favour of biodiversity will be strengthened with the launch of projects promoting local regeneration, more in-depth impact analyses using the GBS (Global Biodiversity Score) method, and with the launch of specific studies and technical partnerships.

In line with its climate change commitments, the Hermès Group will continue its actions in accordance with its objectives, approved by the Science Based Target initiative (SBTi), to reduce scopes 1 and 2 emissions by 50.4% in absolute value and scope 3 emissions by 58.1% in intensity, over the 2018-2030 period. The particularly demanding responsible construction framework will continue to be rolled out for new real estate projects. At the same time, Hermès will increase its contribution to the implementation of carbon offset systems consistent with a net zero carbon target in 2050, supported by Livelihoods’ long-term projects. Hermès will strengthen its role as a socially responsible company alongside its suppliers, which it will continue to support and with the communities in which it operates, whether through site openings, job creation, the development of vocational training centres for its craftsmanship métiers, and contributions to the social and cultural life of the regions.

The Group is looking forward to 2023 with confidence, thanks to its highly integrated craftsmanship model, its balanced distribution network and the loyalty of its customers.

In the medium term, despite the economic, geopolitical and monetary uncertainties around the world, the Group confirms an ambitious goal for revenue growth at constant exchange rates. Thanks to its unique business model, Hermès is pursuing its long-term development strategy based on creativity, maintaining control over savoir-faire and singular communication.

-

1.11Fondation d’entreprise

While the creation of a better and sustainable world has guided the actions of the Fondation d’entreprise Hermès since its creation in 2008, this general interest objective became even more prominent in 2022, as its third five-year term ended. It is in this direction that the four main areas structuring the programmes it sets up, and which it oversees, all converge. Artistic creation, the transmission of savoir-faire, the protection of biodiversity, and solidarity make a concrete contribution to shaping a more humanist society where everyone can flourish, fulfil themselves and, in turn, take action to preserve the planet and pass it on to future generations.

Concerning the transmission of knowledge and training the talents of tomorrow, the Fondation has carried out several large-scale projects. The Artists in the Community programme, which supports many young performing artists, culminated in the itinerant PANORAMA performance presented in September at the Théâtre de la Cité Internationale in Paris. Bringing together the 22 beneficiaries of the first class of artists, this event highlighted performers who will be on tomorrow's stages. In parallel with this achievement, the scholarships awarded by the Fondation in the fall will enable 42 new financially vulnerable theatre, circus and dance students to devote themselves fully to their training over the next three years. In addition, as part of the Skills Academy, the Fondation shared with the public two extensions to the programme dedicated to glass, initiated in 2021: on the one hand, the publication of an encyclopaedic work, “Glass", co-published with Actes Sud and, on the other hand, an exhibition in Marseille bringing together the objects made during the final workshop. The Skills Academy also announced its next programme, dedicated to “Stone”, and new academics were selected from among the craftspeople, designers, engineers and – exceptionally – architects who applied. Lastly, the “Manufacto” programme continued to be rolled out nationwide at the start of the 2022 school year: nearly 1,900 students in 78 classes in 14 partner academies are now learning about craftsmanship savoir-faire during school time.

On the same principle, the “Manuterra” programme, featuring educational content designed to teach children in schools about the living world through an introduction to permaculture, was officially launched after a successful pilot year. At a time when the Fondation is strengthening its commitments to the protection of biodiversity, this component is a strong and forward-looking gesture to raise awareness of environmental issues among younger generations. In four academies, 11 classes already participate in the programme during school hours, i.e. around 280 students. The Fondation also continues to support various targeted initiatives (La Massane forest, Atelier Paysan, Africa-TWIX, Vigie-Nature École, “Agir pour le vivant” festival and La Villette) which employ a variety of methods to respond to ecological challenges and ensure the sustainability of the planet.

The creative field also contributes to making a better world, through the production of works of art intended for a wide audience. This year, the Fondation has scheduled 10 exhibitions of unique artistic universes, in four spaces in Asia (Seoul and Tokyo) and Europe (Brussels and Saint-Louis-lès-Bitche). As part of the New Settings programme, which supports artists creating new forms of performing arts, 15 daring shows supported by the Fondation were presented in 2022 in Île-de-France and Lyon, in partnership with other institutions. The Artists' Residencies also encourage hybrid practices and cross-functionality by enabling visual artists to exercise their creativity within Hermès’ production units and to experience the House’s exceptional savoir-faire along with the bonds formed between craftspeople. In 2022, two residencies took place, resulting in the creation of unique works. The “Immersion” programme, which invites photographers to explore new territories, had two winners in 2022: the American photographer Raymond Meeks worked in France, while his French counterpart Vasantha Yogananthan produced a series of works on American soil. Their perspectives on the current world will be shared with the public from spring 2023.

Lastly, the Fondation supported several general interest projects as part of the “H3 – Heart, Head, Hand” programme. All these solidarity projects are identified by the House’s employees, who also become their ambassadors. Each initiative is rolled out in the territory of the Hermès entity where the reference teams are located, in order to ensure concrete and local action that contributes, at its own level, to building a fairer world.

Through these four main areas of intervention, the Fondation d’entreprise Hermès remains committed on the ground, accompanying the many beneficiaries and supporting the craftsmanship, creative, sustainable and solidarity-based actions that contribute to transforming society. Across the world, these project leaders embody the humanist values of the Fondation d’entreprise Hermès and form a dynamic community aspiring to the common good.

The full report on the activities of the Fondation d’entreprise Hermès is available at: www.fondationdentreprisehermes.org, in the section entitled “The Fondation”.

1.Stores temporarily closed -

2. Corporate social responsibility and non-financial performance NFPS

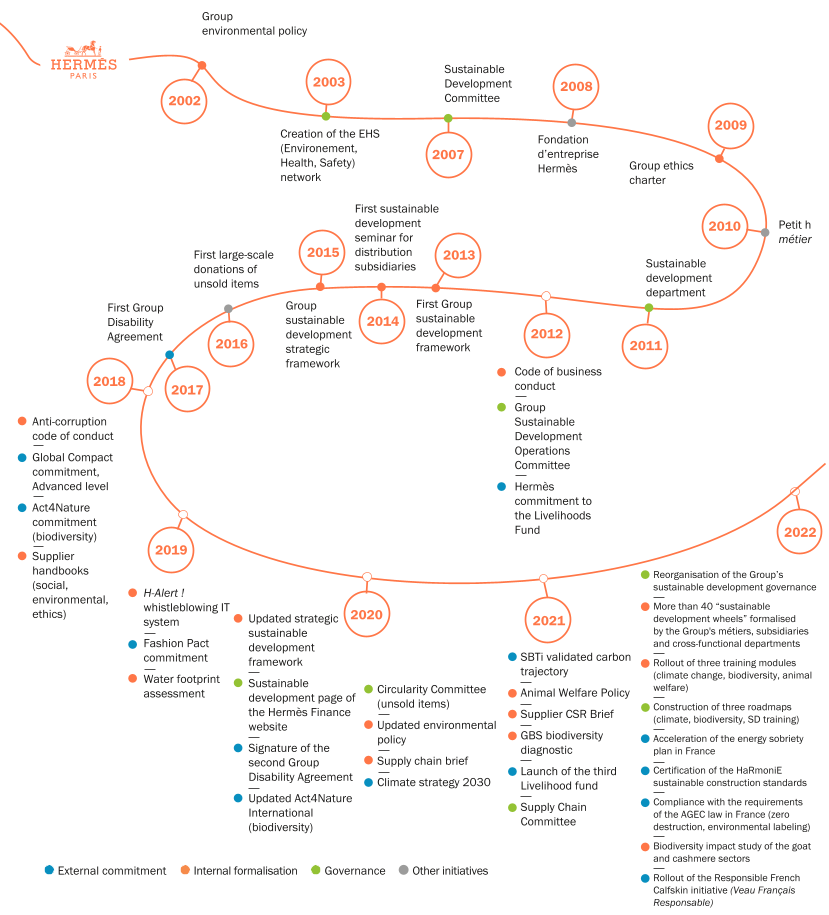

Through its sustainable development approaches, Hermès implements practices that reconcile economic and social progress with preservation of the planet’s natural equilibrium, in a long-term vision. These societal and environmental challenges, linked to the 17 sustainable development goals defined by the United Nations for 2030, provide the framework for the House’s action in this area.

Hermès, a family business, has been able to adapt to changes while favouring a long-term approach. The Group, relying on the strength of its craftsmanship savoir-faire, its exclusive distribution network and its creative heritage, is continuing its sustainable growth.

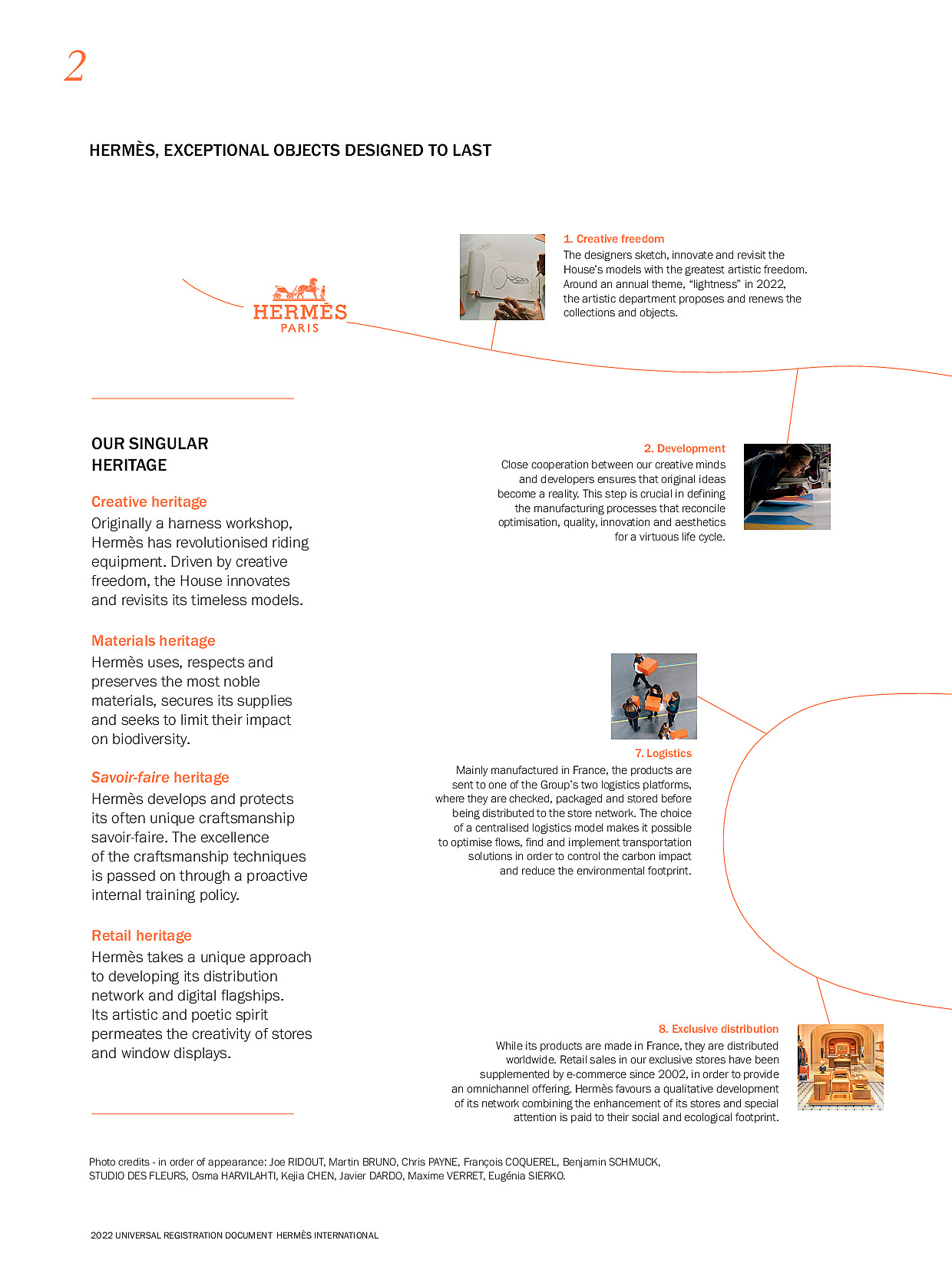

The Group’s craftsmanship manufacturing model is based mainly on the creativity and savoir-faire of men and women working in France. It draws on the House’s four essential heritages: creation, exceptional raw materials, savoir-faire, and the retail universe. It is based on the geographical and cultural proximity between designers and craftspeople. Supported by a network of regional manufacturing sites, Hermès enhances the regions with a desire to ensure the transmission of this exceptional savoir-faire. Finally, it operates with moderation and sobriety in the use of raw materials and with a desire for a low environmental footprint. The promotion of these four heritages has contributed to the sustainability of the Hermès craftsmanship model since 1837.

The Hermès Group’s ambition in terms of sustainable development is to ensure virtuous economic and social development, not only for employees and shareholders, but more broadly for its stakeholders, by thinking about the future of the next generations. This objective will also be achieved by reducing its impacts, however moderate, on the planet. This goal is accompanied by a deep humanist desire to give back to the world some of what the world gives to Hermès. This vision feeds into the House’s strategy and makes it possible to define the priorities, as illustrated below in the materiality analysis conducted along two axes: impacts on the sustainability of the business model and impacts from the Group’s entire supply chain on the world.

The scope of this Non-Financial Performance Statement (NFPS) covers all of the Hermès Group subsidiaries and sites, including all métiers and all regions, the scope of which is detailed in chapter 1 “Presentation of the Group and its results”, § 1.4.

This NFPS is based on the qualitative and quantitative contributions of the métiers (production), subsidiaries (distribution), central departments, and the following Group corporate departments: human resources, industrial affairs, direct and indirect purchasing, real estate, logistics, legal, finance and sustainable development. From the end of the first half-year, the various contributors came together to rank the subjects they wished to prioritise and prepare a schedule extending to the end of the year. Given the time frames, certain annual data is reported at the end of October, in particular for the industrial affairs department. Each department uses tools to consolidate the information related to their activities. These main contributors rely on their respective networks in order to summarise and highlight the most significant progress and the work carried out on the major strategic sustainable development challenges. This operating mode enables a fairer reflection of operating reality, in an environment in which the activities of the House are very diversified.

More specifically, the “Sustainability Information” in chapter 2 has been prepared, in all material respects, in accordance with the reporting guidelines of the industrial affairs and human resources departments, in force as at 31 December 2022, consisting of i. a reporting procedure, ii. a glossary specifying the definitions of Sustainability Information, and iii. other underlying information for the internal reporting tools (hereinafter “the Guidelines”). These guidelines are available on request from the Hermès International headquarters for the financial year ended 31 December 2022.

This work is compiled, standardised and controlled by the sustainable development department, in particular through the implementation of a dedicated digital tool.

Verification work is carried out by an independent third party (PricewaterhouseCoopers), which is also one of the Company’s Statutory Auditors, with audits carried out before publication. Their work enables the issuance of a reasonable assurance report, a higher level of certification than the limited assurance provided for by law in France, on a selection of indicators detailed in § 2.9 and 2.10.

-

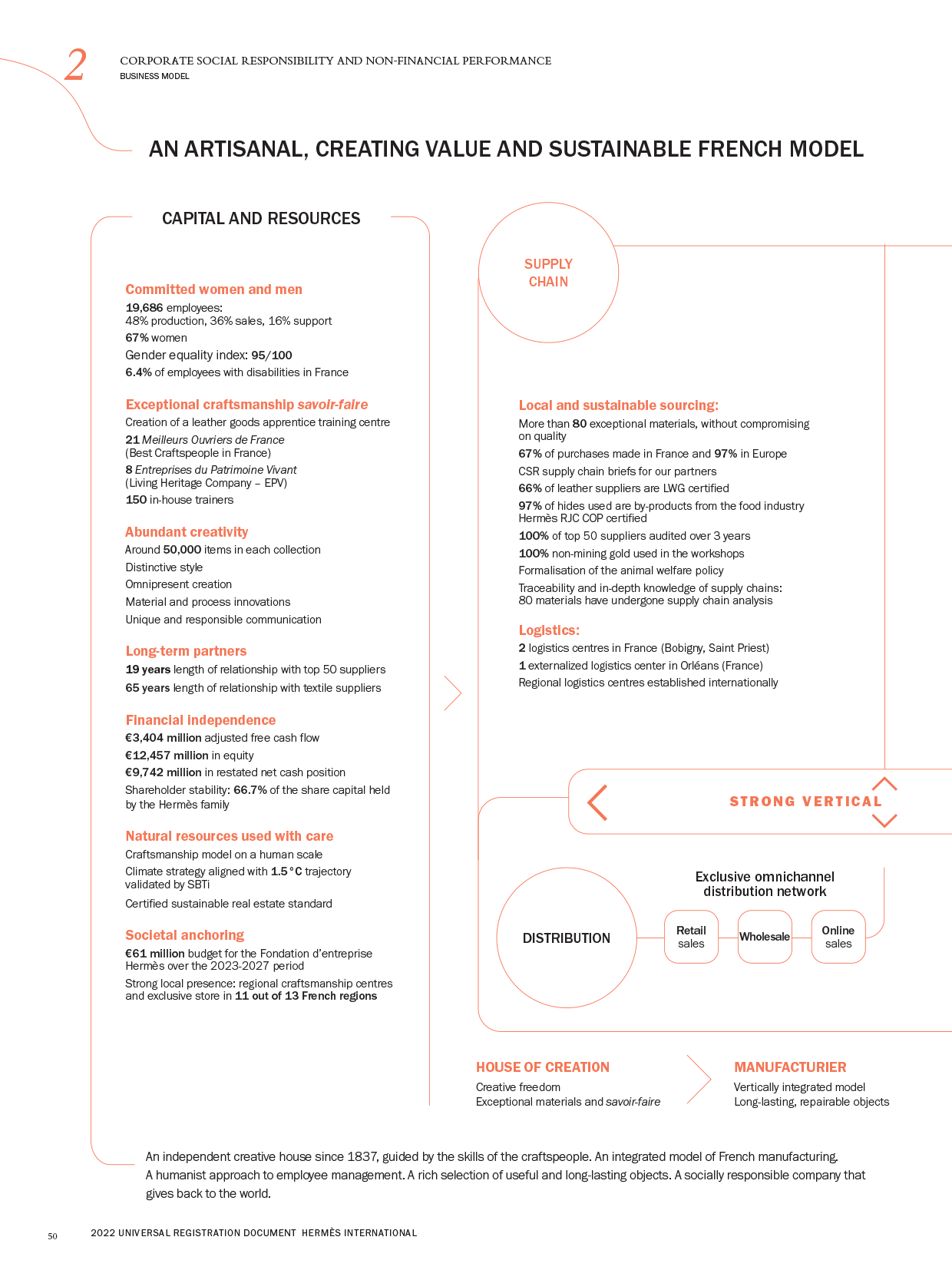

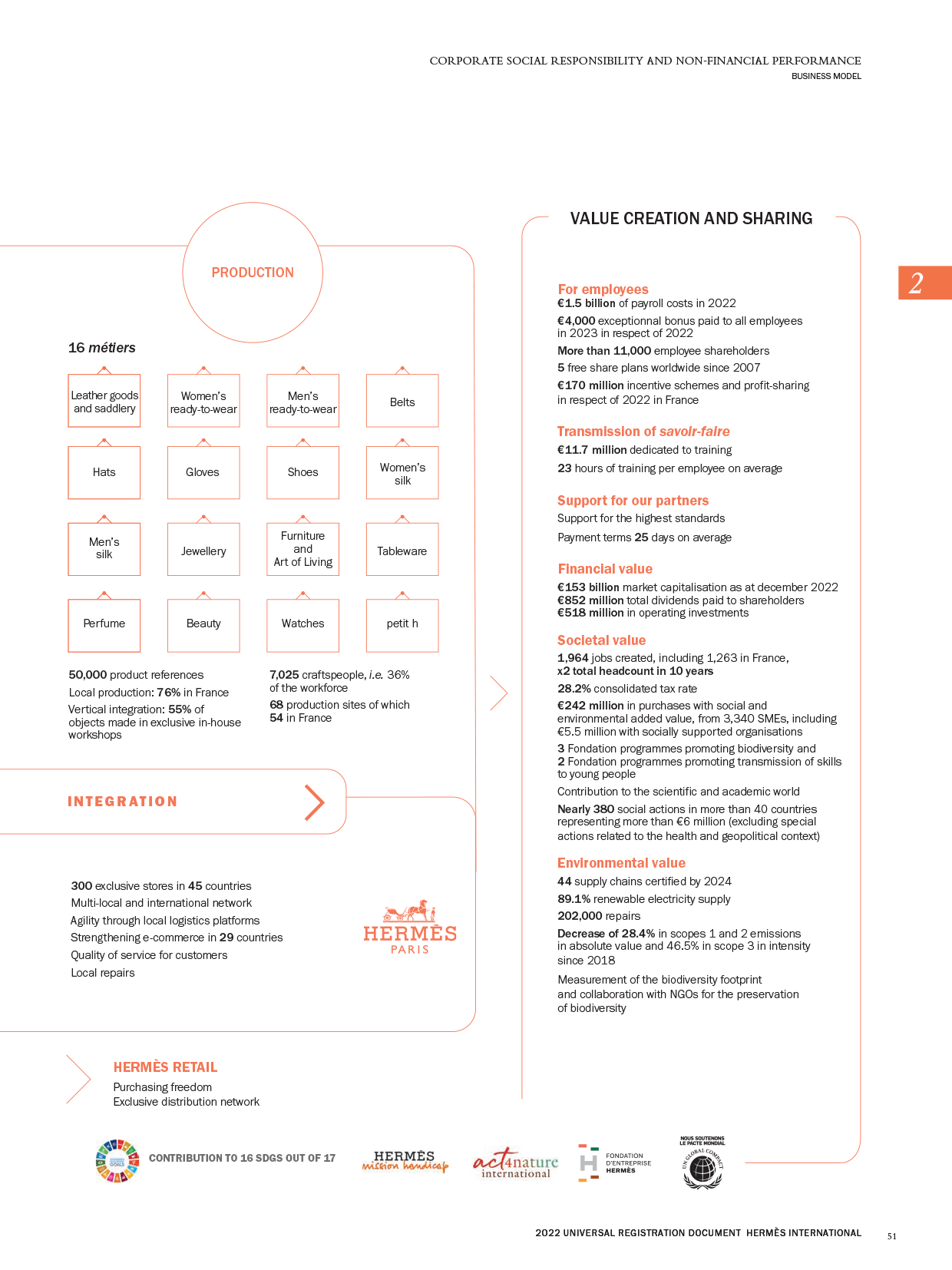

2.1Business model

The Hermès Group presents its value creation model using graphics (see the following pages) in order to put the distinctive features of its highly integrated French craftsmanship manufacturing model into perspective. This approach is designed to help explain the activities of the House, its footprint and contribution to a more sustainable world, in their economic, social, societal and environmental dimensions.

- •a family-run business rooted in a tradition of craftsmanship, the foundations of an eagerness to ensure transmission of skills and sustainability;

- •fundamental heritages, sources of sustainability, that are continuously reinvented: creation, materials, savoir-faire and retail;

- •objects designed to last: rigor and responsibility that are the life force of the House’s 16 métiers (see chapter 1 “Presentation of the Group and its results”, § 1.6);

- •a French House with an international reach: 76% of production is made in France;

- •an integrated model, from the manufacturing of objects made in its in-house and exclusive workshops (55%) to distribution throughout the world, tailored to local situations;

- •controlled development and solid results;

- •a contribution to a more sustainable world through its operating model, through a humanist vision of its activity, the harmonious sharing of value created and a desire to give back to the world some of what the world gives it.

For readers who would like more details on all of the Group’s actions in addition to what is presented in this Non-Financial Performance Statement, the Hermès Finance website can be accessed using this QR Code.

2.1.1Concrete long-term commitments

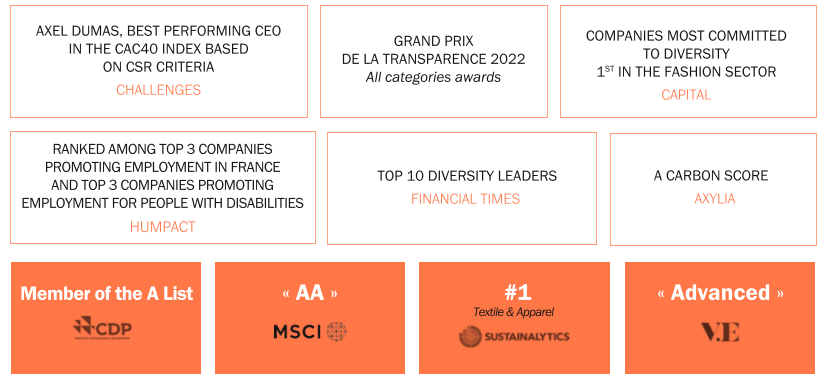

EXAMPLES OF AWARDS RECEIVED AND RANKINGS OBTAINED IN 2022

-

2.2People: teams

Hermès’ sustainable development is based on the fulfilment and well-being of its teams, as part of a corporate project that has placed people at the heart of its values since 1837. More broadly, Hermès nurtures the richness of its human capital and contributes to major societal challenges through proactive initiatives in the areas of ethics, diversity, equality among its employees, consideration of disability and, more generally, respect for human rights.

Introduction

Hermès sets very high standards in terms of working conditions and these are essential to enable employees to thrive, to give meaning to their actions and to help them constantly evolve by renewing knowledge and practices throughout their career.

Beyond the fundamental issues of health and safety at work, this also involves putting in place the best management practices and working environments conducive to the well-being of each and every person on the manufacturing sites, in the stores and offices, to “create beauty in beauty”, as Mr Jean-Louis Dumas used to say.

Harmonious labour relations in France are based on the Group agreement on renewing social dialogue, renewed in 2021 and regularly conducted at both local and central levels. They are also rolled out in all other regions with a humanist mindset that often goes beyond legal obligations.

Hermès' economic successes are regularly shared in different forms and the contribution made by employees to the House’s development, whatever their role, is acknowledged through various profit-sharing mechanisms in order to involve them in the corporate project over the long term. The inclusion in 2019 of a CSR criterion in the variable compensation of the Executive Chairmen makes it possible to assess on an annual basis the achievement of the three indices comprising it, including a criterion relating to gender equality (see § 3.8.1.2.4 and 3.8.2.1.2). The level of achievement is assessed by the CAG-CSR Committee.

In a context of sustained growth in the workforce, it is increasingly important to create links between employees and maintain the House’s culture; this is the reason behind the networking operations that were strengthened in 2022.

Diversity, equity and inclusion are also key factors in the Group’s success. Given the variety of métiers, the profiles of its employees and the various geographical locations, these subjects are treated as Hermès' fundamentals. They therefore need to be addressed daily, and the Group’s ambitions relating to diversity and inclusion issues were strengthened in 2022.

In 2022, the Group made progress on important societal issues, with the aim of making a long-term difference through steady improvements with a significant impact. Among these, the selected elements below are particularly illustrative of the year for this section:

- •finalisation of the rollout of a global maternity policy with compensation maintained, and gradual implementation of a Group paternity policy (launched in France in 2022);

- •launch of prevention programmes in mental health and strengthening of prevention programmes relating to psychosocial risks;

- •rollout of the e-learning module on harassment to all managers in France before extending it worldwide;

- •850 managers were trained in inclusion thanks to the Alterego programme, and 27 Diversity & Inclusion ambassadors covering 100% of the global workforce;

- •launch of the On the Wings of Hermès philanthropic programme involving more than 182 employees;

- •exceptional bonus of €4,000 in respect of 2022 for eligible employees throughout the Group (following a bonus of €3,000 for 2021);

- •top 3 for two Humpact France Awards (employment in France & employment of people with disabilities), inclusion in the Financial Times ranking of diversity leaders

People

TeamsSDG

Objective

Indicators

2022 results

Change 2021/2022

Ensuring fulfilment and well-being of employees

Know and monitor well-being

of employees% of employees and frequency of surveys

79% of employees took part in a survey

during the past 3 years➚

% of the production workforce benefiting from flexible work schedules

95% of the production workforce benefit from flexible work schedules

new indicator

Ensure health and safety at work

Group lost-time work accident frequency rate

8, down 12% compared to 2021

➚

Group lost-time work accident severity rate

0.33 comparable to 2021

=

Protect the Group’s employees

% of employees who benefit from schemes in addition to statutory health, pension and welfare plans

97% of employees worldwide benefit from schemes in addition to statutory health plans

new indicator

96% of employees worldwide benefit from schemes in addition to statutory welfare plans

new indicator

87% of employees worldwide benefit from schemes in addition to statutory pension plans

new indicator

Implement a parenthood policy

% of employees benefiting from

a parenthood policy100% of subsidiaries have rolled out the maternity care policy with salary maintained

=

The vast majority of Group employees

(more than 80%) benefit from salary being

maintained during their paternity leavenew indicator

Sharing the corporate project and its values

Train employees in the House’s values

% of new hires trained in the corporate culture

100% of new hires have received training

in the corporate culture since 2018=

Maintaining the quality of social dialogue

Conduct discussions with social

partners or equivalentNumber of agreements and % of employees concerned

88 agreements and amendments signed in France in 2022, covering 63% of Group

employees➚

Allow employees to express themselves freely via an ethics alert line

% of employees able to use the ethics alert line and number of cases handled

The H-Alert! system is accessible to all

employees. 69 reports were received

in 2022; all reports were followed up➚

Engaging employees in solidarity actions, including skills sponsorship

Develop skills-based sponsorship at Group level

Number of “skills-based sponsorship”

ambassadors80 “skills-based sponsorship”

ambassadors=

Increase in the number of operations

worldwide and increaseNearly 380 operations worldwide

=

SDG

Objective

Indicators

2022 results

Change 2021/2022

ESTABLISHING VALUE-SHARING MECHANISMS

Set up additional compensation as a supplement to salary

Amount of incentive and profit-sharing in France

€170 million in respect of 2022

➚

Exceptional Group bonus paid during

the financial yearExceptional bonuses of €4,000 paid in 2023 for 2022 and €3,000 paid in 2022 for 2021

➚

Implement a minimum compensation policy worldwide

% of employees whose compensation is above the living wage defined locally

Exceptional Group bonus paid during

the financial yearConsidering the entire compensation system implemented at Group level, Hermès

ensures that it pays above the living

wage in all countries where it operates➚

Promote employee shareholding

% employee shareholding

As at 31 December 2022, employee

shareholding represented 0.98% of the

share capital, i.e. over €1,490 million➚

Number of employee shareholders

More than 11,000 employee

shareholders or holders of rights to free shares, i.e. 56% of the workforce

as at 31/12/2022➚

FACILITATING THE INTEGRATION AND RECOGNITION OF TALENTS IN THEIR DIVERSITY, AND PROMOTING EQUAL OPPORTUNITIES AND INCLUSION

Promote the participation of women in company management

Ratio of women present overall within the Company

67% women in the Company

=

Ratio of women on the Executive Committee

40% women on the Executive Committee

➚

Ratio of women on the Operations

Committee67% of the Operations Committee are

women=

Ratio of women managers

60% women managers

=

Ensure equal opportunities

Pay equity index (France)

The weighted average global gender equality pay index is 95/100 vs. 90/100 in 2021

➚

Fight against discrimination

Number of employees who completed

a Diversity and Inclusion training course850 employees took part in “management of diversity” training

➚

Promote inclusion, particularly for people with disabilities

% of the workforce affected by a “Disability” action plan

100% of the workforce in France concerned

=

% of employees with disabilities

in the workforce in France6.4% rate of directly employed people with disabilities in France (2021 rate) vs. 5.7% (2020 rate)

➚

Continue to recruit young people under the age of 30

% of employees under the age of 30

19% of employees under the age of 30

➚

-

2.3People: savoir-faire

Hermès’ sustainable development involves preserving its savoir-faire and ensuring that it will be maintained over time thanks to the various mechanisms put in place. One of its key assets is the acquisition, enrichment and transmission of the savoir-faire of its employees. More broadly, Hermès contributes to the preservation and sustainability of multiple types of craftsmanship savoir-faire, particularly in the manufacturing sector, which is conducive to a more responsible and sustainable local economic development.

Introduction

Hermès contributes to the preservation and sustainability of craftsmanship savoir-faire through its École Hermès des Savoir-Faire and its training centres as well as its partnerships with vocational schools throughout France (whose expertise is also used by other economic players). Promoting its métiers externally and with younger generations in particular is a key aspect of its actions. By bringing the wealth and excellence of craftsmanship to the attention of a large number of stakeholders, and by expressing future needs, particularly in the manufacturing sector, Hermès is helping to create rewarding careers and professional prospects.

The advantage and appeal of the Hermès model is its ability to expand its wealth of internal talents to complement the needs of the different types of jobs with very diversified activities within the House. Its ability to recruit, and then train its employees using an internal method of transmission of savoir-faire, guarantees the sustainability of its business model.

To continue to develop its model, its culture and its unique savoir-faire, the House continually invests in training initiatives that enable employees to acquire new skills. This commitment to employee training is reflected in all métiers and in a multimodal approach with the creation of digital pathways. For production and distribution activities, training programmes are tailor-made and rolled out locally or by the Group in Paris. This can be seen, in particular, in the acquisition of savoir-faire in an employee’s first job as a leather worker, in the engineering incubator within the École des Tanneurs and the École du Textile, and the qualifications gained through certification or diplomas.

In 2022, the Group made progress on the main issues relating to transmission, with the aim of making a long-term difference through steady improvements with a significant impact. Among these, the selected elements below are particularly illustrative of the year for this section:

- •first anniversary of the in-house leather goods CFA (“École Hermès des Savoir-Faire”);

- •creation of an École des Artisans de la Vente training centre (France);

- •more than 341,000 hours of training, a training rate of 76%, giving more around 23 hours of training per person;

- •nearly 4,200 people made aware of sustainable development via the “SD fundamentals” online training course;

- •rollout of the CSR programme in three stages for the Hermès métiers (Ready-to-wear, Shoes, Home, Fashion Accessories, etc.);

- •development of Digital Learning with, in particular, the launch of a collection of e-learning modules: “My first sale” for Retail or “Lock” on cybersecurity issues.

People

Savoir-faireSDG

Objective

Indicators

2022 Results

Change 2021/2022

Fostering new careers as craftspeople

The École Hermès des Savoir-Faire: a place of excellence and transmission

Develop partnerships with training

organisations to certify the training

received and the savoir-faire acquiredNumber of partnerships with educational

establishments for training and internal CFA13 partnerships with Écoles

de Maroquinerie in France and 1 in-house CFA, the École Hermès des Savoir-Faire

created in 2021Target of 600 CFA graduates in 2023 and 650 in 2024

➚

PROMOTING AND VALUING THE TRANSMISSION OF SAVOIR-FAIRE EXTERNALLY

Implementation of workforce planning management

% of employees affected by the rollout

of the planLaunch of the “strategic workforce planning” project

Promote our métiers through

partnerships with educational

establishmentsNumber of students reached by school

actions45 presentations carried out in different educational establishments, reaching more than 3,000 students in France

new indicator

Integrating and developing employees and teams

IMPLEMENT SYSTEMS TO RECRUIT THE BEST PROFILES FOR THE VARIOUS MÉTIERS

Develop tools and use relevant

channels to recruit talentNumber of job offers published on the

career website and number of

applications submittedAn average of 280 online job offers each month on the career website in 2022 and 958 applications submitted on the site each day.

new indicator

Number of annual posts on LinkedIn

and frequency of posting on LinkedIn

and other KPIs (tools)2.5 posts per week on average on LinkedIn in 2022

=

Ensure the recruitment of suitable

profiles for all our métiers worldwideNumber of new employees worldwide

6,203 new employees in the last five years

➚

An average of more than 8 new hires per day in 2022

➚

Number of new employees in the production sector

978 additional jobs created in the

production sector (x2 in one year)➚

Number of new employees in the sales

sector727 additional jobs created in the sales

sector (+70% year-on-year)➚

ENSURING THE SUSTAINABILITY AND DEVELOPMENT OF SAVOIR-FAIRE

Train employees in the House’s values

Number of employees reached by induction actions

More than 600 employees followed the Group induction programme in France

new indicator

Ensure access to employee training

% of employees having followed at least one training course

76% of employees having benefited from a training course

new indicator

Number of training hours delivered

worldwide23 hours of training per person

new indicator

Develop tailor-made training

programmes for employeesNumber of internal trainers to pass on savoir-faire

150 in-house leather goods trainers for 18 leather goods workshops

➚

SDG

Objective

Indicators

2022 results

Change 2021/2022

Integrating the challenges of sustainable development into savoir-faire

Develop training on sustainable

development topics for all métiersNumber of training sessions related

to sustainable development issues,

accessible in the Group catalogue1 e-learning course proposed in order

to deliver a common knowledge base

to everyone, and available in 6 languages:

The fundamentals of sustainable

development3 thematic e-learning courses, made

available to employees: Climate Change,

Biodiversity and Animal Welfarenew indicator

Number of employees trained in the CSR

programmeMore than 4,200 employees followed

“The fundamentals of sustainable

development” courseMore than 2,100 people participated in

Biodiversity and Animal Welfare e-learning courses➚

Create and lead a network

of ambassadors to generate a training

impact and ensure it is relayed

at local levelNumber of employees responsible for SD

within the Group44 employees in charge of sustainable

development within the Group

(x2 compared to 2021)➚

Number of SD ambassadors around the world

351 SD ambassadors around the world

=

Ensure that employees are properly

informed about the Group’s sustainable development strategy and actionsNumber of HermèSphère publications

dedicated to sustainable development1 publication per week on CSR topics

published in HermèSphère, i.e. nearly 20%

of content published annually=

INCLUDING CAREER PATHS IN A LONG-TERM VISION

Set up long-term career development programmes within the Group

Average number of years of seniority in the Group

8.4 years average seniority of employees (worldwide),

6% increase in the workforce of people with more than 15 years of service

Total number of internal transfers

More than 800 internal transfers Group-wide

➘

Continuing voluntary actions relating to training for the historical métiers and developing manufacturing savoir-faire

Continue voluntary actions relating to training for our historical métiers and develop manufacturing savoir-faire

Promote craftsmanship businesses

8 Entreprises du Patrimoine Vivant (Living Heritage Company ‒ EPV)

Demonstrate the excellence of our savoir-faire

21 Meilleurs Ouvriers de France (Best craftspeople in France – MOF)

-

2.4The planet: raw materials

Sustainable development at Hermès is based on exceptional raw materials, from renewable natural sources, which enable it to create long-lasting objects. The materials are obtained with a determination to control their environmental footprint and used with respect by optimising their usage. More broadly, Hermès is committed to sustainably developing its supply chains, by going beyond compliance with environmental, ethical and social regulations, and contributing to the future availability of these resources. Lastly, Hermès is committed to measuring its impacts on biodiversity and taking action to preserve it.

Introduction

Hermès’ flagship materials – leather, silk, cashmere and wood – are all natural, renewable and obtained in such a way as to minimise their footprint. The model and values of craftsmanship guiding the House have always promoted the careful and respectful use of these rare and precious materials. Craftspeople take great care not to waste resources, to use only what they need and to optimise the use of materials. Naturally, the Hermès Group does not use materials or species that are threatened with extinction or are sold illegally. Recycled materials are increasingly used in manufacturing. In all métiers, channels are also identified to recover and recycle manufacturing offcuts, in addition to the emblematic activities of petit h, a pioneer in this area since 2010.

The materials are selected and supplied in each of the métiers within the framework of a rigorous process set out in the “supply chain brief” and detailed in technical specifications, complying with regulations, respecting biodiversity and best practices, in the constant quest for the highest quality and ethical integrity. These supply chain briefs are intended for all suppliers and manufacturers involved in supplying Hermès métiers. They are also accessible on the Group’s corporate website. For decades, the House’s approach has been to ensure it has in-depth knowledge of its supply chains, to share its requirements with its suppliers (often long-standing partners) and to develop them to achieve the highest quality and thus prepare for future growth.

The creation of Hermès objects depends on a quality ecosystem, able to provide it with exceptional materials. It is therefore fundamental for the sustainability of Hermès’ business model to respect and protect biodiversity, and to implement science-based objectives in its direct and extended sphere of responsibility. For the Group, this involves voluntarily engaging beyond the sphere of influence and aligning its action plans with international standards such as SBTN (Science-Based Targets for Nature) or TNFD (Taskforce on Nature-Related Financial Disclosures).

MAIN COMMITMENTS OF THE PLANET PILLAR: RAW MATERIALS

In 2022, the Group made progress the main issues relating to materials, with the aim of making a long-term difference through structural improvements with a steady and significant impact. Among these, the selected elements below are particularly illustrative of the year for this section:

- •enrichment of all supply chain briefs (12 new materials integrated, 62 in total);

- •implementation of the LCA approach in the House’s emblematic product métiers;

- •exploration of new materials, such as the Victoria bag in “Fine Mycelium” made using biotechnology (mushrooms) or VulcaniumTM (recycled leather);

- •operational implementation of the “zero destruction” objective for unsold items in France (Agec law);

- •rollout of the CSR self-assessment questionnaire to suppliers;

- •renewal audit for the third period of RJC COP (“Code of practices”) certification;

- •the Hermès Horloger workshops producing the watch cases and dials obtained RJC COC (“Chain of Custody”) certification;

- •Inclusion in CDP A List (ranking A on CDP Water and A- on CDP Climate);

- •strengthening of internal biodiversity awareness-raising actions.

Planet

MaterialsSDG

Objective

Indicators

2022 Results

Change 2021/2022

Seeking the highest quality for all the materials used, guaranteeing the objects’ durability

Have the highest quality materials

and those best adapted to the

functionalities and uses

of the productsNumber of different leathers used

by the House35 different leathers used by the House

=

Number of raw materials identified

88 raw materials identified

➚

Strengthen vertical integration to

ensure mastery of savoir-faire and the quality of materials and develop long-term relationships with producersProportion of certified livestock farms

99.3% of the crocodilian hides used by the Tanneries division come from ICFA-certified

livestock farms100% of ostrich farms SAOBCS-certified

➚

Optimising the use of raw materials throughout the life cycle by integrating the principles of the circular economy

Identify eco-design levers and courses

of action for all products% of métiers having implemented an LCA

approach on their emblematic productsMore than 80% of the métiers carried out

at least one LCA on their emblematic

products➚

Establish a circular economy roadmap

in all métiersProportion of métiers that have formalised

a Circular Economy roadmap100% of métiers have included a section

dedicated to the circular economy in their roadmap=

Engage in a process of recycling

co-products from other industriesProportion of leathers from hides recycled from agri-food channels

97% of leathers used by Hermès come from agri-food channels

=

Favour the use of recycled materials

when relevant100% recycled gold and silver for Jewellery

100% non-mining gold and silver used

in Hermès Bijouterie workshops=

Develop upcycling, recycling and

donation processes to improve and

manage product end-of-lifeQuantity of recycled materials

18 tonnes of textile materials recycled

in 2022 (21 tonnes in 2021)➘

Length of partnership with the leading

association for the circular economySince 2016, Hermès has partnered with

charitable associations to provide

donations in kindImplementation of processes to achieve the target of 0 destruction of unsold items from 2022 in France (Agec law scope)

0% destruction in France from 1 January 2023 (Agec law scope), target extended

globally between 2025 and 2030

Incorporate a circular and

eco-responsible approach into creationNumber of products put on sale that

incorporate a circular approachMore than 2 million products incorporating a circular approach developed in 2021

new indicator

Carry out product repairs

Number of products repaired

202,000 products repaired in 2022 (161,000 in 2021)

➚

Finding alternatives to the use of certain materials, including plastics

Improve the impact of all packaging,

from production to customers to

transportation% of packaging (customers and

intermediaries) made from renewable,

recyclable and/or recycled materials100% of orange boxes and bags are made from renewable, recyclable and/or recycled materials

=

Eliminate single-use plastics

% single-use virgin plastic by 2025

100% of plastic hangers recycled

=

Consolidate the use

of natural materialsNaturalness indicator (Perfume and Beauty)

61% of ingredients used in perfumery are classified as natural or of natural origin, as are 58% of ingredients used in cosmetics

new indicator

SDG

Objective

Indicators

2022 Results

Change 2021/2022

CONTROLLING THE ENTIRE VALUE CHAIN WITH OPERATIONAL TRACEABILITY AND PARTNERSHIPS

Analyse all purchasing categories and supply chains

% of purchasing categories where risks have been mapped and number of supply chains subject to in-depth analysis

80 supply chains analysed representing 99% of revenue

➚

% of calf hides traced to the livestock farm

In 2022, 40% of the calf hides tanned in

the two calf hide tanneries of the HCPdivision were marked to ensure their

traceability➚

% of exotic hides traced to the farm

100% of crocodilian and 100% of ostrich hides are traced back to the livestock farm

=

Use leathers from geographical areas with low social and environmental risks

% of materials sourced in Europe for leather

91% of hides sourced in Europe

=

ContributING to the development of the most demanding standards on the management of supply chains in terms of environmental, social and ethics criteria, particularly in terms of animal welfare

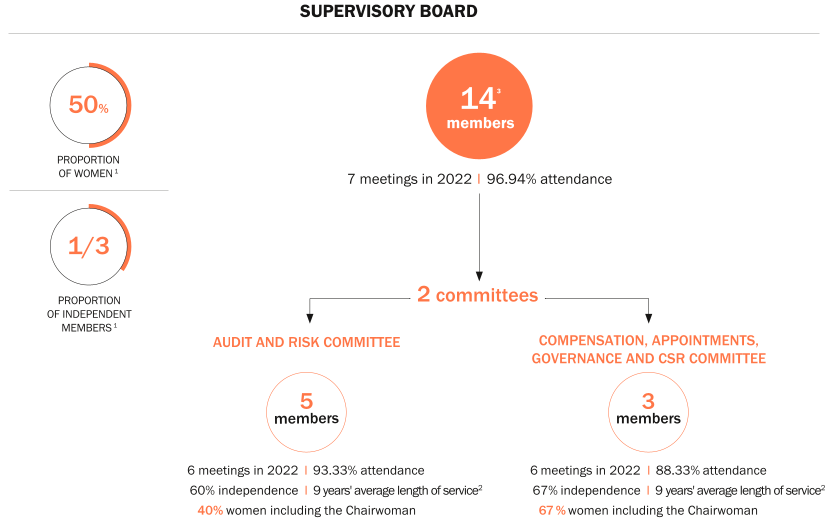

Contribute to the creation of